Mayor Sly James loves his city: Kansas City, Missouri.

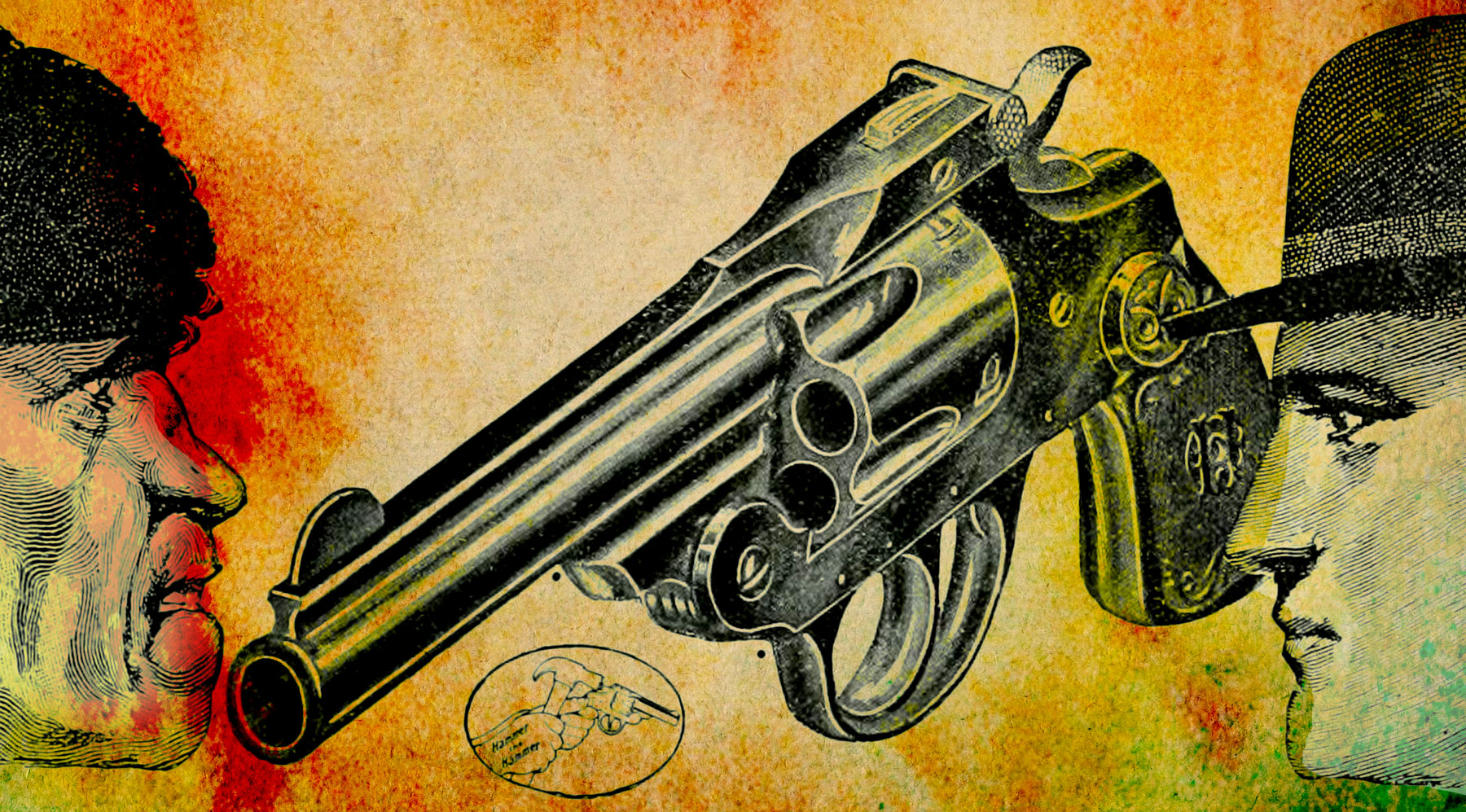

He dreams of a shining new airport on a hill, a land of milk and honey with a new, luxurious, taxpayer-financed downtown hotel. He envisions it as a harmonious hub in which the thrill of … waiting for a richly subsidized streetcar is ubiquitous.

Yet, at every turn, a group of pesky citizens, Citizens for Responsible Government, has dashed the mayor’s dreams.

How?

- A 2013 initiative petition drive blocked the $1.5 billion airport project.

- Through a 2014 initiative effort, voters soundly defeated a streetcar expansion.

- Weeks ago, this same rambunctious mob of retirees turned in enough signatures to force a public vote regarding the $311 million subsidy plan for a new downtown hotel.

“This is democracy at work,” claims Dan Coffey, serving as the group’s spokesperson.

For his part, the mayor offers, “I respect the people’s right to voice their opinion, but … I’m going to fight for this hotel deal.”

A man of principle!

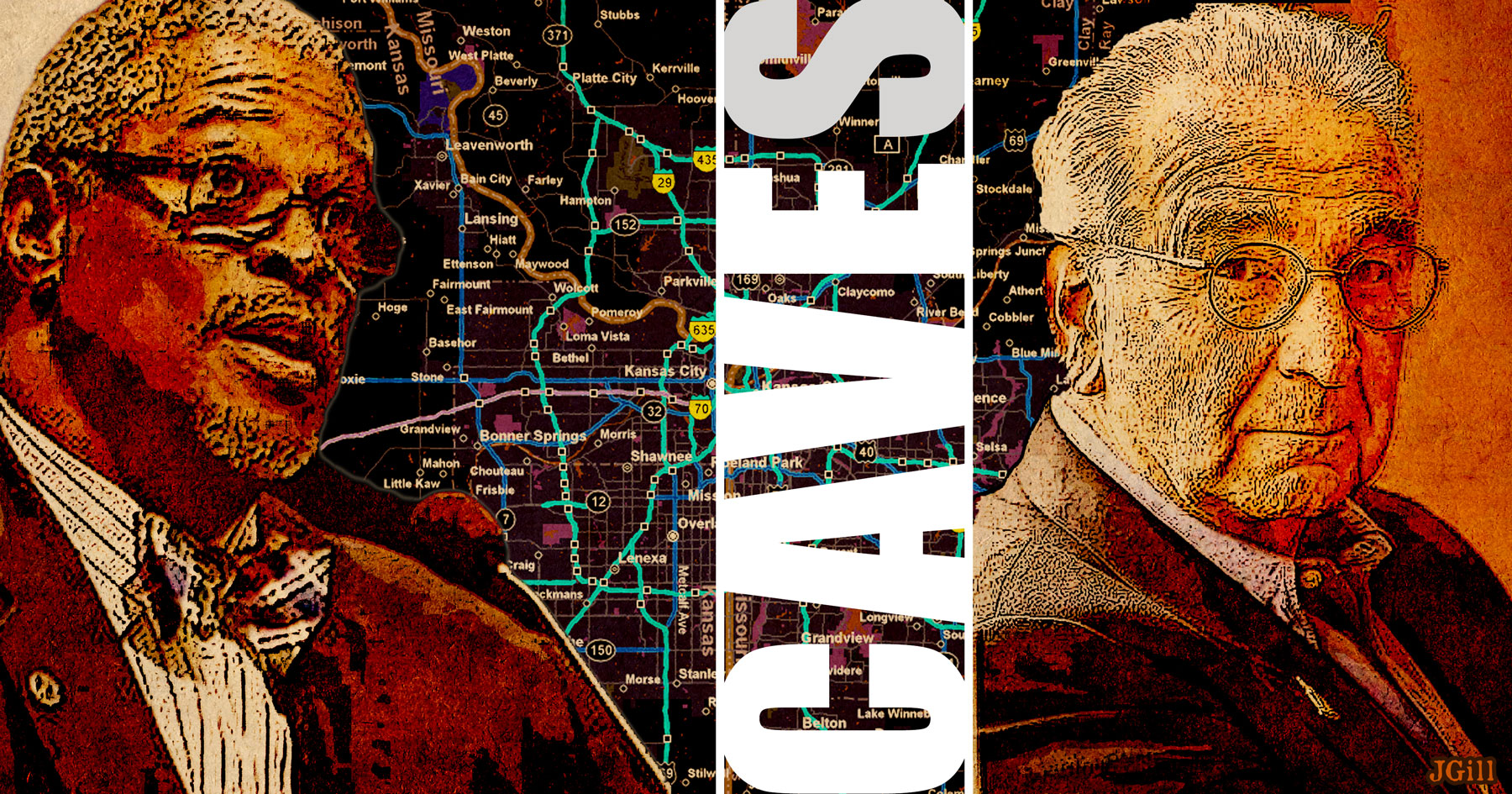

Mayor Sly has taken to calling Coffey’s group CAVE — “Citizens Against Virtually Everything.” Coffey only notes that the mayor has left out a letter: the acronym should be CAVES — “Citizens Against Virtually Everything Stupid.”

“We started off a group of interested citizens that didn’t like the way things were going, particularly the way taxpayer money was being spent in Kansas City,” Coffey recently told the Kansas City Star. “Everybody talks about it, but nobody does anything about it.”

Coffey’s group has changed that dynamic … using direct democracy.

This is Common Sense. I’m Paul Jacob.