Eighty-seven thousand new IRS agents!

What could possibly go wrong?

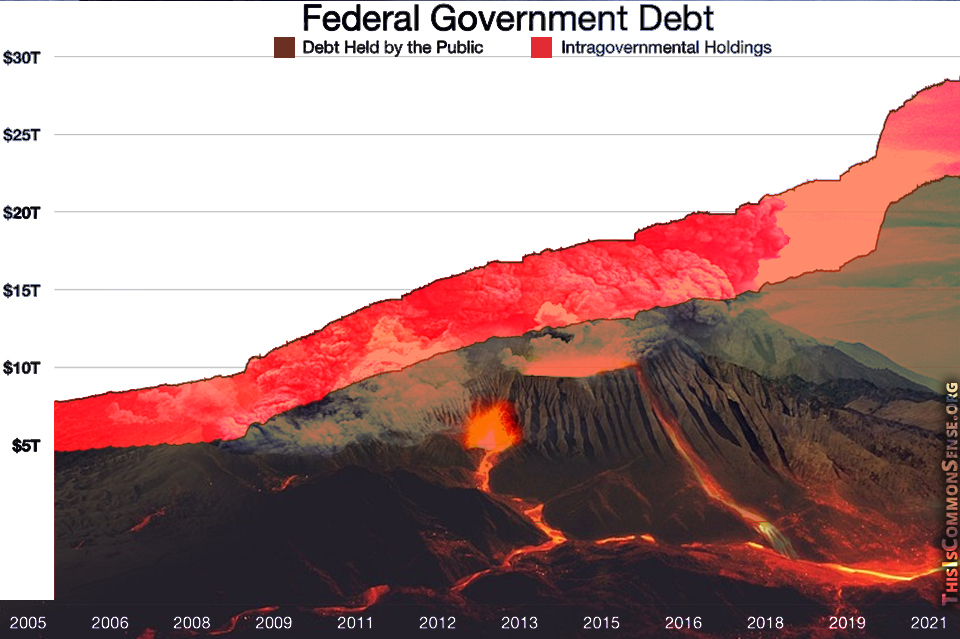

In a bill passed and signed last August, “$80 billion worth of new funding over the next decade” was shoveled at the Internal Revenue Service “so it could” — as a recent Reason article summarizes — “hire 87,000 new workers, purportedly to better target millionaire and billionaire scofflaws.”

The assurance that the new investment in personnel would not be directed towards “those making under $400,000 annually” was, as Reason’s Liz Wolfe makes clear, “not provided within the text of the actual bill.”

Ah — political promise over actual law and all bureaucratic experience. The IRS, you see, prefers to focus its audits on the lowest income earners, who were audited more often than millionaires.

Why? Well, the key is one feature of the tax code: the earned income credit. Which, it just so happens, is easy to get wrong. And upon which lower-income workers have come to rely.

The other reason is even more basic: “given a dearth of experienced auditors not likely to be fixed soon, the agency would rely on the easiest and least time-consuming types of audits.” Which are conducted through the mail. Easy. Cheap. And annoying.

Even with more IRS auditors with more experience, this path of least resistance — these earned income credit audits — will likely get the most use.

The reasons behind the reasons? Why were Democrats so eager to increase the ranks of tax collectors? Sure, Democrats love taxes. But like most tax hikers, they promote the idea that others will pay all those taxes; they promise to stick it to the rich … while ever-so consistently missing the mark and whacking the poor and middle classes.

This is Common Sense. I’m Paul Jacob.

Illustration created with Midjourney and DALL-E2

—

See all recent commentary

(simplified and organized)