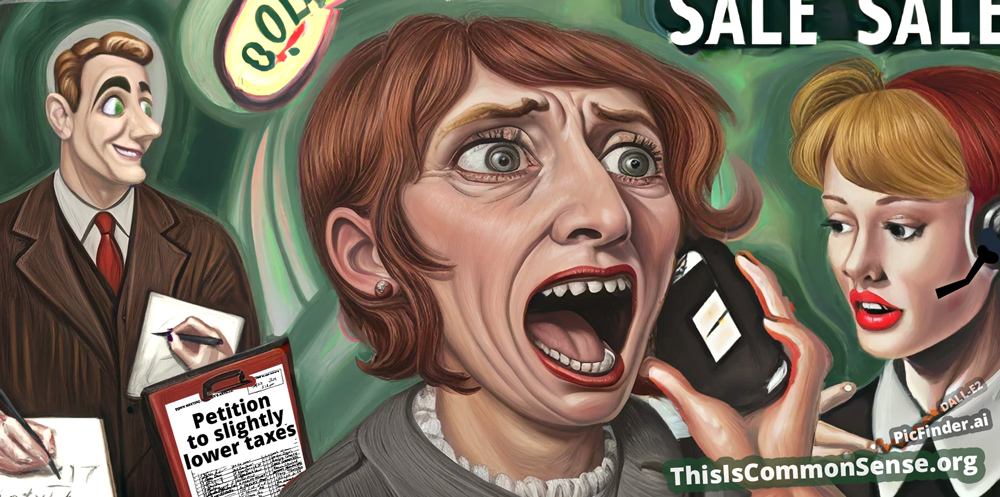

There are long-standing debates among those who oppose big government. One is whether we should promote every budget cut and any tax cut, or whether we should more-or-less carefully support only some cuts — on the grounds that some possible cuts might scuttle future reforms.

This came to mind upon hearing Michigan Governor Gretch Whitmer’s plan to reduce the budget of one of her state’s bureaucracies by

Hooray!

But wait a moment: the department to be cut is the Office of the Auditor General!

Whitmer’s proposal is to take the $30 million budget and bring it down to a lean

The point of an auditor is to make sure that government does not misuse the money taken from taxpayers, allegedly for the public benefit. Take that away, and what do you have?

Waste. Corruption — a recipe for it, anyway. Maybe an engraved invitation for it.

Is there any merit to this reduction? Democrats are not known to love budget cuts.

They say Michigan’s auditor’s office has been “too partisan” — and certainly said things about Democrat programs that don’t make those programs

“If there is ever a place in Lansing where we should rise above petty partisan politics, it should be oversight and ethics,” Rep. Tom Kunse (R-Clare) said, expressing a perspective I share.

So what’s really going on here? Well, the state is facing a $418 million surplus. That’s a lot of money to play with. What’s the likelihood that the party in charge wants to reduce the Auditor’s Office for any other reason than to reduce scrutiny of how they plan to spend that money?

This is Common Sense. I’m Paul Jacob.

Illustration created with PicFinder and Firefly

—

See all recent commentary

(simplified and organized)