There’s good news about inequality?

In late March, George F. Will argued that the truth about inequality in America, according to his op-ed title, is “awkward for the left and right.”

He points to the reality of transfer payments in the United States.

Ignoring that reality is what leads to awkwardness.

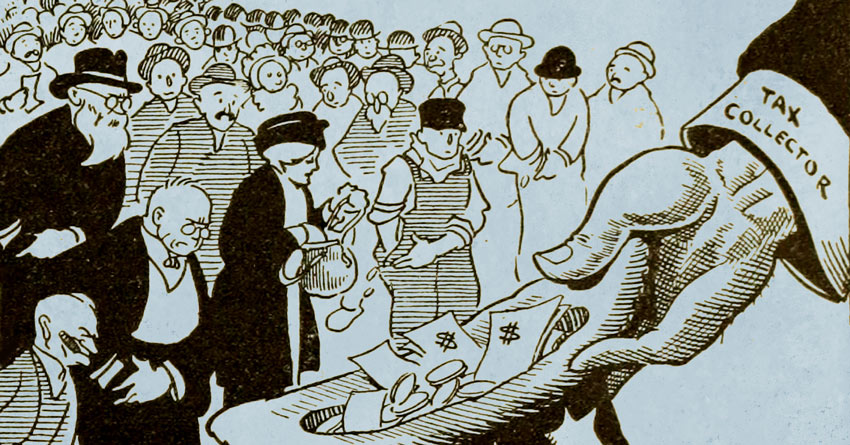

On the left, critics of capitalism portray low-income earners as a growing class of the impoverished . . . and high-income earners as a growing class of filthy rich.

But by “not counting about 88 percent of government transfer payments that enlarge the buying power of lower-income households, and not counting taxes that lower the wealth of higher-income households, government statistics purport to prove that the average income in the top quintile of earners is 16.7 times that of the average in the bottom quintile. Counting transfers and taxes, however, the actual ratio is 4 to 1.”

So leftists ignore the “successes” of the very system they set up, the better to complain and demand more of what has already been done.

But what do rightists ignore?

That’s where Mr. Wills’s Washington Post editors (a class of professionals who usually determine titles and blurbs) may have given us the wrong impression. Most of his column explodes leftist interpretations of contemporary reality. But he does talk about “the populist right,”: the “national conservatives” who mimic the progressive left in favoring “industrial policy” that, he notices (as I’ve noticed here at Common Sense) “regressively funnels money upward to corporations.

“The populist right advocates protectionism (tariffs to shield corporations from competition), and the populist left advocates hundreds of billions of dollars of subsidies (for semiconductors, electric vehicles, solar panels, etc.).” Both favor the rich when it comes to regulations, while complaining about the rich in other contexts.

A poor way to help the poor.

This is Common Sense. I’m Paul Jacob.

Illustration created with PicFinder and Firefly

—

See all recent commentary

(simplified and organized)