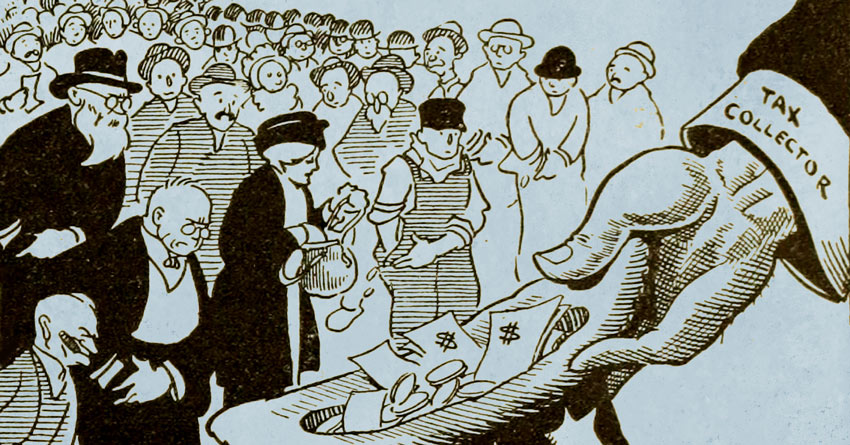

Connecticut has a budget problem. There’s not enough money to spend.

WTNH-TV in New Haven paraphrased the situation along with the response of Connecticut’s very progressive governor: “Income tax revenue collapses; Malloy says taxing the rich doesn’t work.”

The news story explains, “Connecticut’s state budget woes are compounding with collections from the state income tax collapsing, despite two high-end tax hikes in the past six years.”

Hmmm. Despite the tax increases? Or . . . “because the state of Connecticut depends too much on its wealthy residents,” as the report continued, “and wealthy residents are leaving . . .”

A Yankee Institute report notes that “the exodus of wealth from the state as top earners and businesses relocate to more tax-friendly states” is a major problem. Institute President Carol Platt Liebau calls it a “terrible cycle of tax increases followed by deficits followed by even more tax increases.”

Yet, state legislative Democrats are back pushing more tax hikes on “the rich.” Senate legislation would jack up the tax rate — retroactively — on those with income of $500,000 or more. House legislation would slap a 19 percent surcharge on some hedge fund earnings. In response, the head of the Connecticut Hedge Fund Association testified that his “industry is populated by exactly that type of person that will move based on tax policy.”*

A song by Ten Years After comes to mind:

Tax the rich, feed the poor

Till there are no rich no more

Doesn’t sound like a good idea even in song.

This is Common Sense. I’m Paul Jacob.

* It’s worth noting that Gov. Malloy is now “against raising taxes again to fill the deficits and is instead focusing on spending cuts . . .”