“We can do $10 trillion,” declared Rep. Alexandria Ocasio-Cortez (D-NY) last week.

“I know that may be an eye-popping figure for some people,” explained the photogenic pop-eyed pol, “but we need to understand that we are in a devastating economic moment, millions of people in the Unites States are unemployed, we have a truly crippled health-care system and a planetary crisis on our hands, and we’re the wealthiest nation in the history of the world.”

In other words, the sky is falling . . . and we still have checks.

The Bronx congresswoman, described as “one of the most influential members” by MSNBC’s Rachel Maddow, trumpeted that tidy sum in response to last week’s “go big” proposal by President Joe Biden to spend a special new $2.2 trillion under the loose label of infrastructure, which AOC argued “is not nearly enough.”

This new two-tril spending bill is “a follow-up to the $1.9 trillion stimulus approved in March.” And just Part 1 of a two-package infrastructure and other stuff Biden plan.

“The White House is reportedly willing to spend $4 trillion across the two packages,” Business Insider reports, “a sum that would bring recovery spending under his term to nearly $6 trillion.”

Biden’s term has been only 76 days.

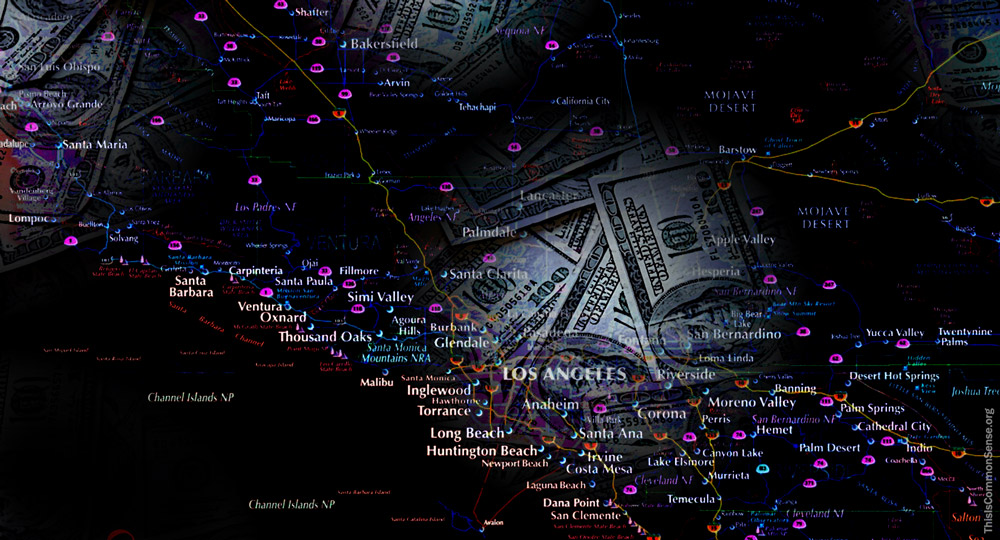

A couple trillion here, a couple trillion there and pretty soon you’re talking real money . . . except under Modern Monetary Theory, which Ocasio-Cortez embraces. The idea being: government can print as much money as politicians want to spend.

While this road to bankruptcy has been paved with the partisan political intentions of big spending politicians of both major parties, right now it is the Democrats hitting the gas.

This is Common Sense. I’m Paul Jacob.

—

See all recent commentary

(simplified and organized)