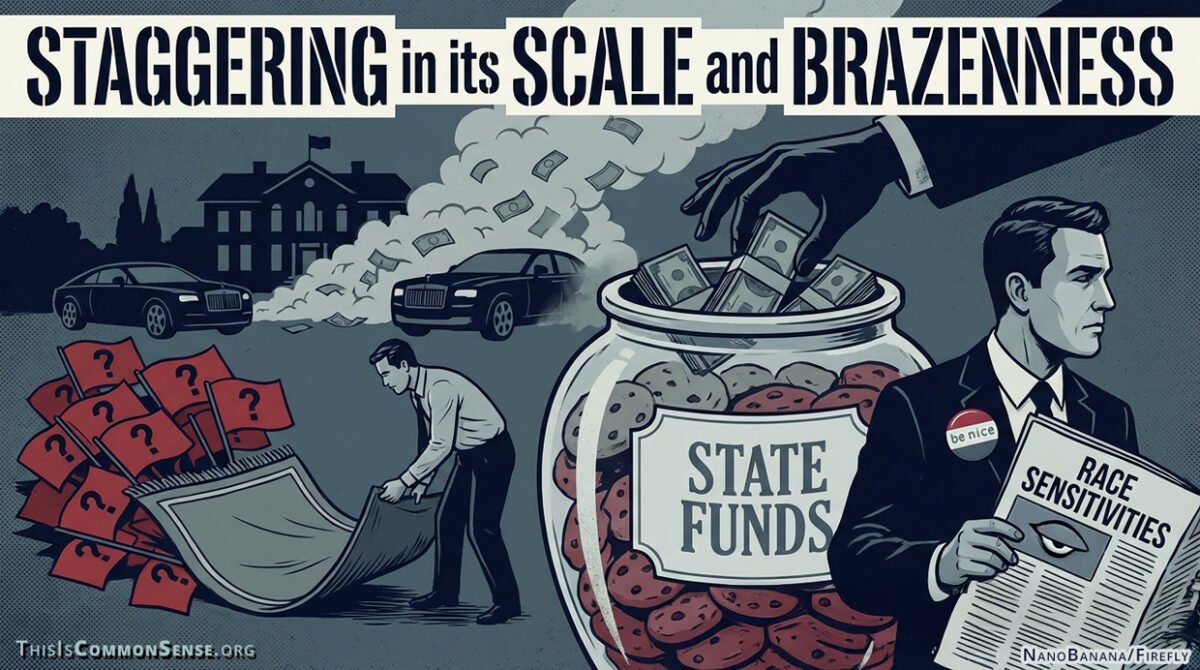

“Staggering in its scale and brazenness.”

That’s how The New York Times describes the more than $1 billion in fraud that “took root in pockets of Minnesota’s Somali diaspora as scores of individuals made small fortunes by setting up companies that billed state agencies for millions of dollars’ worth of social services that were never provided.”

Quite a lucrative business model: Stealing from programs to prevent homelessness and keep children fed during the pandemic, the crooks instead “spent the funds on luxury cars, houses and even real estate projects abroad.”

So far, prosecutors have convicted 59 people, with “all but eight of the 86 people charged” of “Somali ancestry.”

According to Ryan Pacyga, an attorney representing several defendants, The Times reports that “some involved became convinced that state agencies were tolerating, if not tacitly allowing, the fraud.”

What?

“No one was doing anything about the red flags,” argues Pacyga. “It was like someone was stealing money from the cookie jar and they kept refilling it.”

Why was nothing done?

Well . . . the federal prosecutor contends that what The Times calls “race sensitivities” (read: fear of being called racist) were “a huge part of the problem.”

One former fraud investigator, a Somali American named Kayseh Magan, blames “the state’s Democratic-led administration” which was “reluctant to take more assertive action in response to allegations in the Somali community.”

“There is a perception that forcefully tackling this issue might cause political backlash among the Somali community,” Magan explains, “which is a core voting bloc.”

For Democrats.

Very expensive votes.

This is Common Sense. I’m Paul Jacob.

Illustrations created with ChatGPT, NanoBanana and Firefly

See all recent commentary

(simplified and organized)

See recent popular posts