“We cannot be complacent,” Federal Reserve Bank President Charles Evans said yesterday. He was most distressed by any lingering notion that the economy would remain undamaged were “no action” taken.

He wants more money flushed into the system. “If we continue to take only modest, cautious, safe policy actions,” he argued, “we risk suffering a lost decade similar to that which Japan experienced in the 1990s.”

Ah, and I was going to use the long Japanese recession as an example of what can happen when too much monetary and bailout hanky-panky is allowed.

Evans apparently thinks that mid-September’s unleashing of quantitative easing — or QE, the currently fashionable banker’s version of crony capitalism — with the Fed promising monthly $40 billion purchases of mortgage-backed securities, is tantamount to “no action” and “doing nothing.”

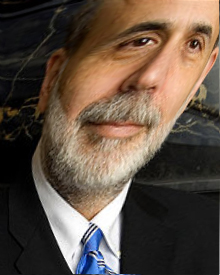

Or else he’s worried that Bernanke’s critics might have some sway.

Relying on the old (by-the-textbook but long-discredited) Phillips Curve story of inflationary money leading inexorably to increased employment, cheap money maven Evans told reporters that “the economy” would “need 200,000 to 250,000 job gains per month” before the Fed could dare rethink its current policy.

He’s apparently forgotten that stagflation is possible. I don’t know why: He’s just a few years older than me, and I remember when the Phillips Curve’s simple trade-off between inflationary monetary policy and unemployment rates hit the trash bin of history, as both inflation and unemployment soared in the 1970s.

When our leaders forget history, are we doomed to repeat it?

Stagflation may be the best we can hope for from current QE.

This is Common Sense. I’m Paul Jacob.