When you systematically reward failure, incompetence and irresponsibility…what results should you expect?

QE – Toxic Asset Government Purchases

Click below to get a high resolution version of this image:

When you systematically reward failure, incompetence and irresponsibility…what results should you expect?

QE – Toxic Asset Government Purchases

Click below to get a high resolution version of this image:

“We cannot be complacent,” Federal Reserve Bank President Charles Evans said yesterday. He was most distressed by any lingering notion that the economy would remain undamaged were “no action” taken.

He wants more money flushed into the system. “If we continue to take only modest, cautious, safe policy actions,” he argued, “we risk suffering a lost decade similar to that which Japan experienced in the 1990s.”

Ah, and I was going to use the long Japanese recession as an example of what can happen when too much monetary and bailout hanky-panky is allowed.

Evans apparently thinks that mid-September’s unleashing of quantitative easing — or QE, the currently fashionable banker’s version of crony capitalism — with the Fed promising monthly $40 billion purchases of mortgage-backed securities, is tantamount to “no action” and “doing nothing.”

Or else he’s worried that Bernanke’s critics might have some sway.

Relying on the old (by-the-textbook but long-discredited) Phillips Curve story of inflationary money leading inexorably to increased employment, cheap money maven Evans told reporters that “the economy” would “need 200,000 to 250,000 job gains per month” before the Fed could dare rethink its current policy.

He’s apparently forgotten that stagflation is possible. I don’t know why: He’s just a few years older than me, and I remember when the Phillips Curve’s simple trade-off between inflationary monetary policy and unemployment rates hit the trash bin of history, as both inflation and unemployment soared in the 1970s.

When our leaders forget history, are we doomed to repeat it?

Stagflation may be the best we can hope for from current QE.

This is Common Sense. I’m Paul Jacob.

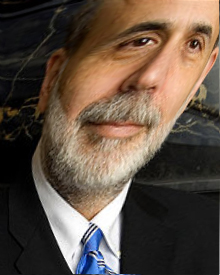

Last week, the Federal Reserve announced it was going ahead with “quantitative easing.” Chairman Ben Bernanke said that he’d be buying $40 billion dollars of mortgage-backed securities every month, no end in sight.

Now, the traditional way that the Federal Reserve influenced the money supply, economist Randall Holcombe explains, was via “open market operations by buying and selling government securities.” But this changed in 2008 with the $85 billion AIG bailout: “Since then it has engaged in continual bailouts of financial firms and purchases of non-government securities. . . .

The Fed has moved from engaging in monetary policy in a way that was neutral toward various businesses and industries in the economy to one in which monetary policy is targeted toward specific firms and industries. This current foray, specifically targeted at the housing market, is crony capitalism.

It’s actually worse. It’s crank policy, as the redoubtable Mr. Peter Schiff summarizes: “Ben Bernanke’s plan to revive the U.S. economy and create jobs is to inflate another housing bubble. That’s it. That’s what the Fed’s got. That’s what it came up with. As if the last housing bubble worked out so well for the economy that the Fed wants an encore.”

Our leaders are obviously desperate.

And out of control. George Will states that the Fed has gone far beyond “mission creep” — it’s “mission gallop on part of the Fed, which is on its way to becoming the fourth branch of government — accountable to no one and restrained by nothing, as far as I can tell, in exercising both monetary and fiscal policy.”

This is what forsaking limited government and the Constitution gets you: a sort of frantic idiocy in aid of politically connected speculators and financiers.

This is Common Sense. I’m Paul Jacob.

Earlier this week I did a short Q&A about the latest in monetary policy: quantitative easing. This video goes into much more detail. And is pretty funny:

For an extended, non-animated explanation of QE, try a helpful article by monetary economist Leland Yeager: “The Fed’s Easy Money.”

It’s one of those terms seemingly designed to conceal something ugly, dangerous, or unnerving; this example of contemporary policy jargon just looks like a euphemism. It’s “quantitative easing” (QE) and it’s Federal Reserve policy.

What does the “quantitative” part refer to?

The quantity of money in bank reserves.

Is this all about increasing that quantity?

Yes.

Isn’t that synonymous with inflation?

According to the old definition — where inflation is the increase in the supply of money — yes. But since economists became obsessed with the price level, and “correcting” the price level, today inflation usually designates a general rise in prices. Of course, more money will tend to raise prices. But because demand for money can offset supply moves, price levels are not affected on a simple input-output, one-to-one manner.

Is this what we call “printing money”?

Yes, but in the digital ledgers of banks, not in terms of paper dollars.

So this “easing” is just “easy money”?

Yes, but not “just.” Because the new money hits bank reserves, it eases banks’ pressure vis-a-vis risk. So banks can lend more.

Will banks, helped out by QE, actually follow through and make loans?

Big question. They didn’t, much, after the bailouts. Banks loan funds only when they can expect a return. Monetary manipulation doesn’t, presto chango, solve the problem of the future. If the future looks especially unstable, or uncertain, no loan.

Will this necessarily jump-start the economy?

No. Our elite experts’ desperation is showing.

This is Common Sense. I’m Paul Jacob.