When last we touched upon the strangely over-the-top Californian reaction to the Trump presidency, the secession movement, I took the occasion to bring up the rather less radical separatists in the north. “Already 21 of the 23 northernmost counties,” I wrote, “have made declarations to form the State of Jefferson.”

But now there is a new wrinkle.

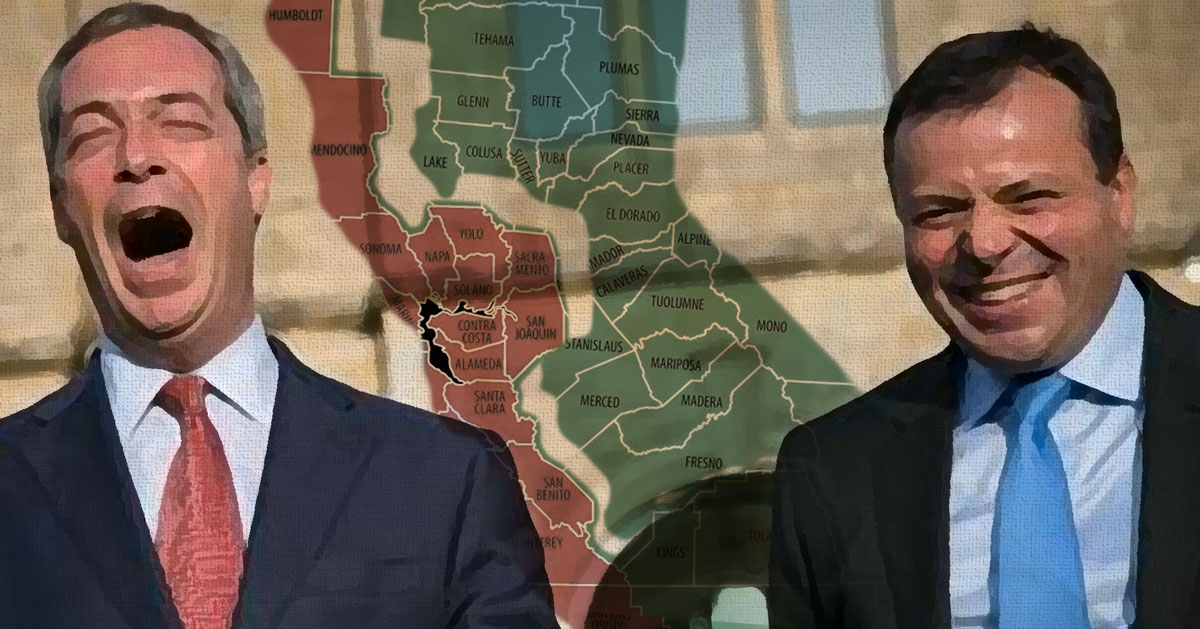

“Former UKip leader Nigel Farage and Leave backer Arron Banks recently helped raise $1 million for Calexit, which would split California into eastern and western regions,” we learn from the Daily Mail and the World Tribune. Banks, citing the high disapproval ratings Californians give their government, said that “he and Farage wanted to show people in California ‘how to light a fire and win’ the Calexit referendum.”

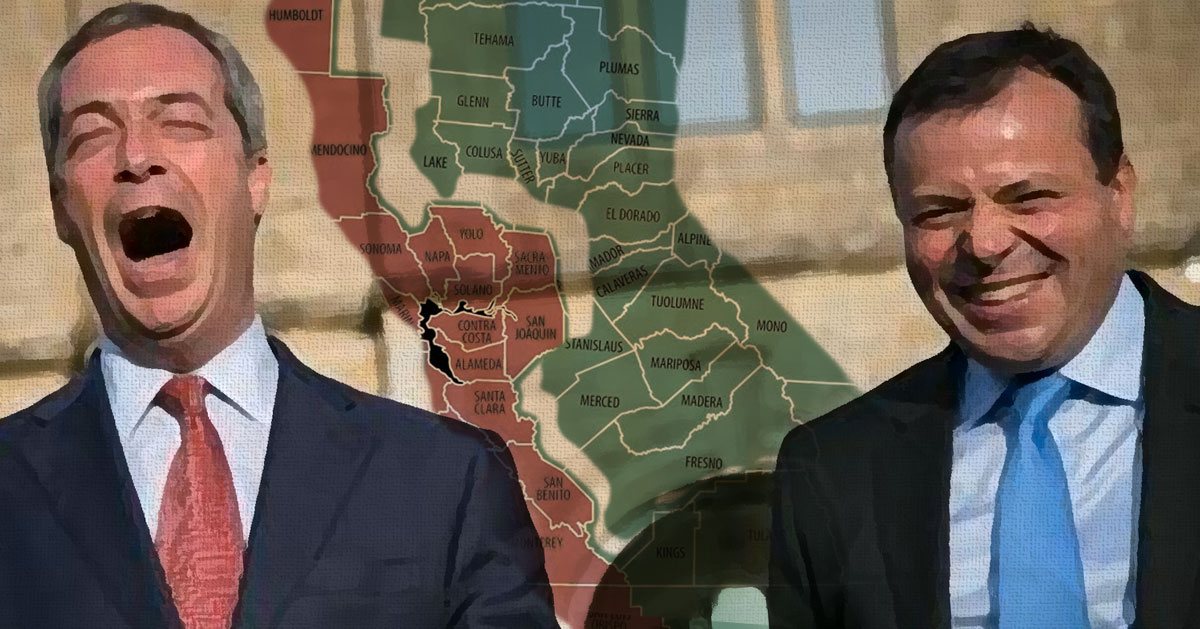

Their proposal is distinct from complete secession. It would amount to a California split, with the west coast (Los Angeles and north to the border) splitting off from the rest of the state. This would form an East California and a West California.

Politically, this might appease the conservatives and moderates who live in more rural east and Southern California, especially since they are coming to increasingly despise Left Coast “liberals” (read: progressives). Whom they not implausibly blame for ruining the state.

But it leaves some Jefferson secessionists stuck with those “liberals.” This, if an oversight, is a big one. Would this not doom the scheme?

While the failed initiative effort of 2014 to split the state into six separate states was far too complicated to wrap one’s head around, the new Calexit effort seems too . . . simple.

This is Common Sense. I’m Paul Jacob.