The crazed nature of our leaders’ willingness to spend beyond revenue, and accumulate debt, is not limited to one party. Both Democrats and Republicans are responsible for their outrageously perverse fiscal policies.

Their irresponsibility hides in plain view, and can be seen in most of the major policy discussions of our time. Take two:

- the Democrats’ idea of putting every American on Medicare and

- the Republicans’ current tax reduction bill.

Though the Republicans often pretend to be all about something called “fiscal conservatism,” their murky tax plan is not fiscally sound. Not yet, anyway — after all, it is “evolving.”

And I expect it to get worse, not better.

“The current plan proposes about $5.8 trillion in tax reduction offset by about $3.6 trillion in base-broadening offsets, meaning that it would result in a $2.2 trillion deficit increase over the next decade,” Peter Suderman summarizes over at Reason.

They have a number of cuts in the works, but also plan to spend more on defense and the like. The debt would go up.

But if the Republicans are hypocritical and irresponsible, the Democrats add sheer insanity to their irresponsibility.

“Medicare for All” is pushed by Senator Bernie Sanders, who serves Vermont, where a similar universal system was enacted, only to be repealed after it proved unaffordable even with huge tax increases. All single-payer/socialized medicine proposals would require whopping tax increases to work, and the increases in spending would inevitably yield greater deficits.

Besides, Medicare is heading for financial Armageddon. Adding more burdens to a system that they cannot (or simply will not) now make solvent?

Only a politician could consider such a “solution.”

This is Common Sense. I’m Paul Jacob.

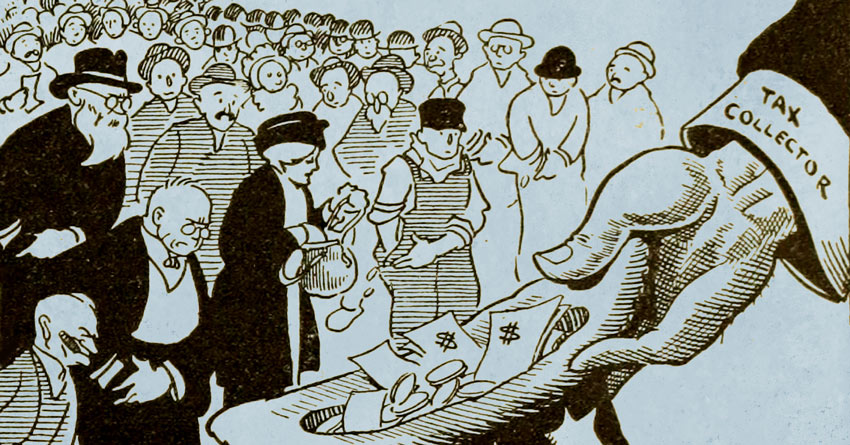

Art by John Goodridge on Flickr