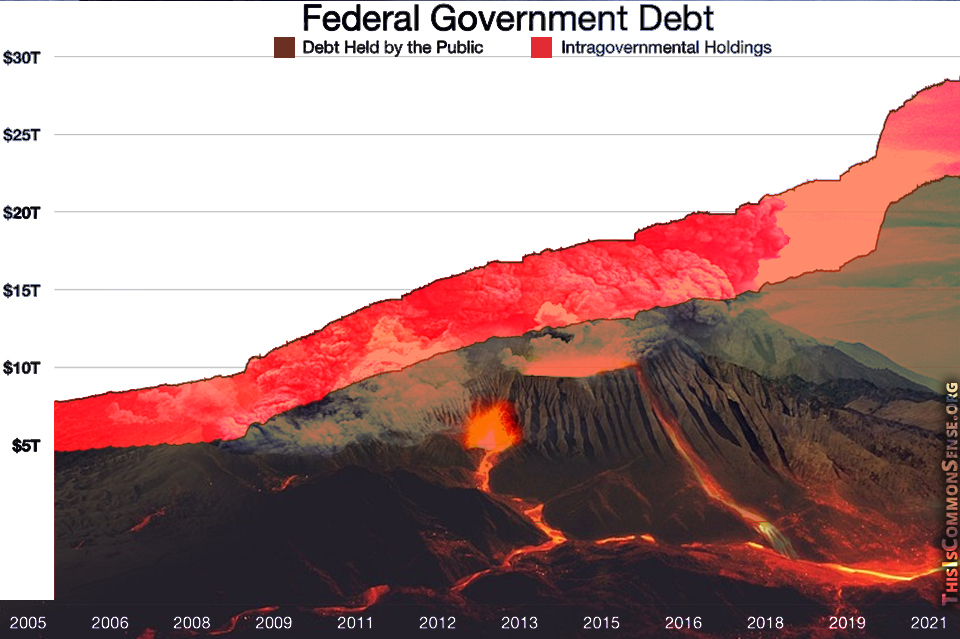

The big secret of the federal government’s budget is that there isn’t one.

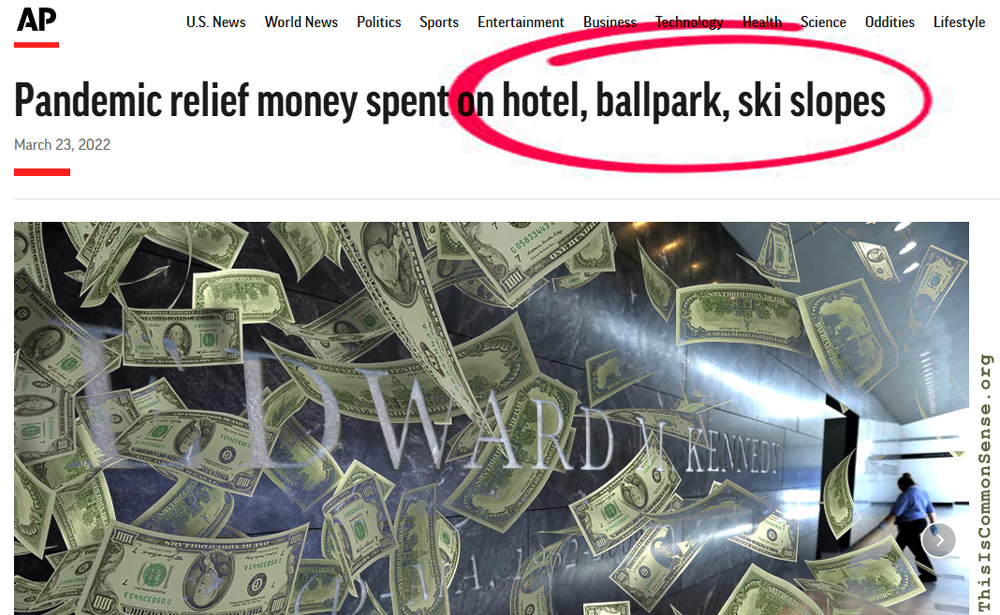

Instead of proposing a rational budget, Congress spends money in huge omnibus bills, which sweep up most of the big items into a bucket which is then poured out into the economy. Since these buckets contain more money than can actually be found in federal coffers, the consequent deficits are covered by debt.

Which accumulates.

Looming larger and more ominous every year.

One way these omnibus bills are managed is that almost no one reads them. As former House Speaker Nancy Pelosi said of Obamacare, ya gotta pass it to find out what’s in it.

How to get congressmen to go along with this financial chaos? Bribery. Make the spending binge even bigger with earmarks.

That’s where members of Congress place local boondoggle projects into the omnibus bills and get them through without having to convince anyone but the leadership of the projects’ dubious merits.

I used to talk more about earmarks. But when the Tea Party Republicans entered in 2011, they nixed earmarking “the pork.”

When the Democrats came back into power, the aforementioned Mrs. Pelosi brought them back, which, in the last big omnibus bill, pushed spending up an extra $8 billion or so.

Though Democrats love earmarks as an institutional practice, Republican protests are often merely pro forma. Alabama’s Retiring Republican Senator Richard Shelby, for example, “got $666.4 million down there to Alabama,” explained Tom Temin recently. “Sounds like there’s going to be a lot of Richard Shelby bridges, Richard Shelby schoolhouses, Richard Shelby highways.”

Thankfully, one of the concessions Speaker of the House McCarthy made with the Freedom Caucus (whom the president calls “ultra-MAGA” and “semi-fascist”) was to attack the earmarking practice again — after a failure to decide against earmarks late last year.

We’ll see how that goes. But the real test will be the abandonment of omnibus spending packages.

This is Common Sense. I’m Paul Jacob.

Illustration created with Midjourney and DALL‑E 2

—

See all recent commentary

(simplified and organized)