Going into the lockdowns and bailouts, a consensus of politicians and their court wizards, the economists, had belittled the specter of inflation.

Nowadays, when folks use the term “inflation,” they really mean upward movement on the consumer price index (CPI). Some economists, who have a sense of history,* reserve the word not for price level increases, but for increases in the supply of money. And the two concepts are tightly linked.

But a whole lot of people seek to blame CPI rate increases on anything but monetary policy, as Veronique de Rugy notes in an article at The American Spectator.

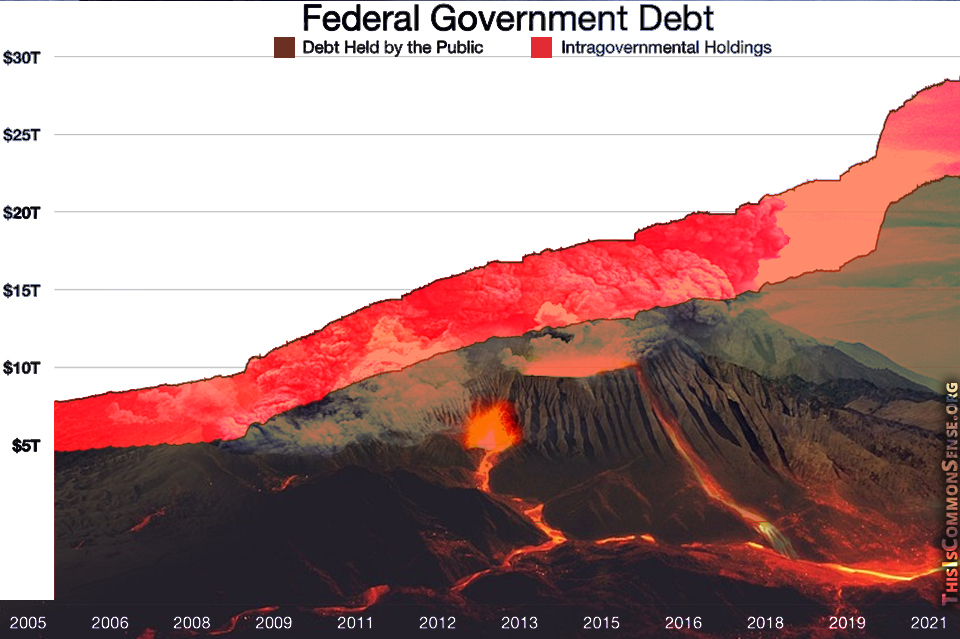

“Theories for why we shouldn’t worry abounded,” de Rugy writes. “It was caused by a base-effect price increase, supply-chain restraints, a drought in Taiwan — everything but the Fed’s expansionary policies and Congress’ overspending, in part because some of these experts had cheered for these actions all along.”

And then inflation came back.

Big time.

While expressing some humility and an unwillingness to make predictions, de Rugy insists that “the amount of money printed, borrowed, and spent during the last few years led to a one-time price level rise, and we may have a way to go until we are done.”

She also insists that the Pollyanna phrase “transitory inflation” is no comfort: “inflation was always going to be transitory. Even the inflation of the 1970s ended in the ’80s. What mattered is whether transitory inflation meant a few weeks, months, or years.”

And, I cautiously add, how de-stabilizing it is. Consumers rightly worry about rising prices, but inflation doesn’t hit all sectors the same. Credit expansion leads to imbalances that are hard to correct.

And the correction is “depression.”

This is Common Sense. I’m Paul Jacob.

* Including the history of their own discipline. Readers of Austrian economists such asF.A. Hayek get a better sense of past debates than from other economists.