“In 2024 alone, state Medicaid Fraud Control Units reported more than 1,151 convictions and more than $1.4 billion in civil and criminal recoveries,” writes Veronique de Rugy at Reason. “Federal enforcement recovers a tiny share of what is stolen. Fraud that goes undetected never appears in the data.”

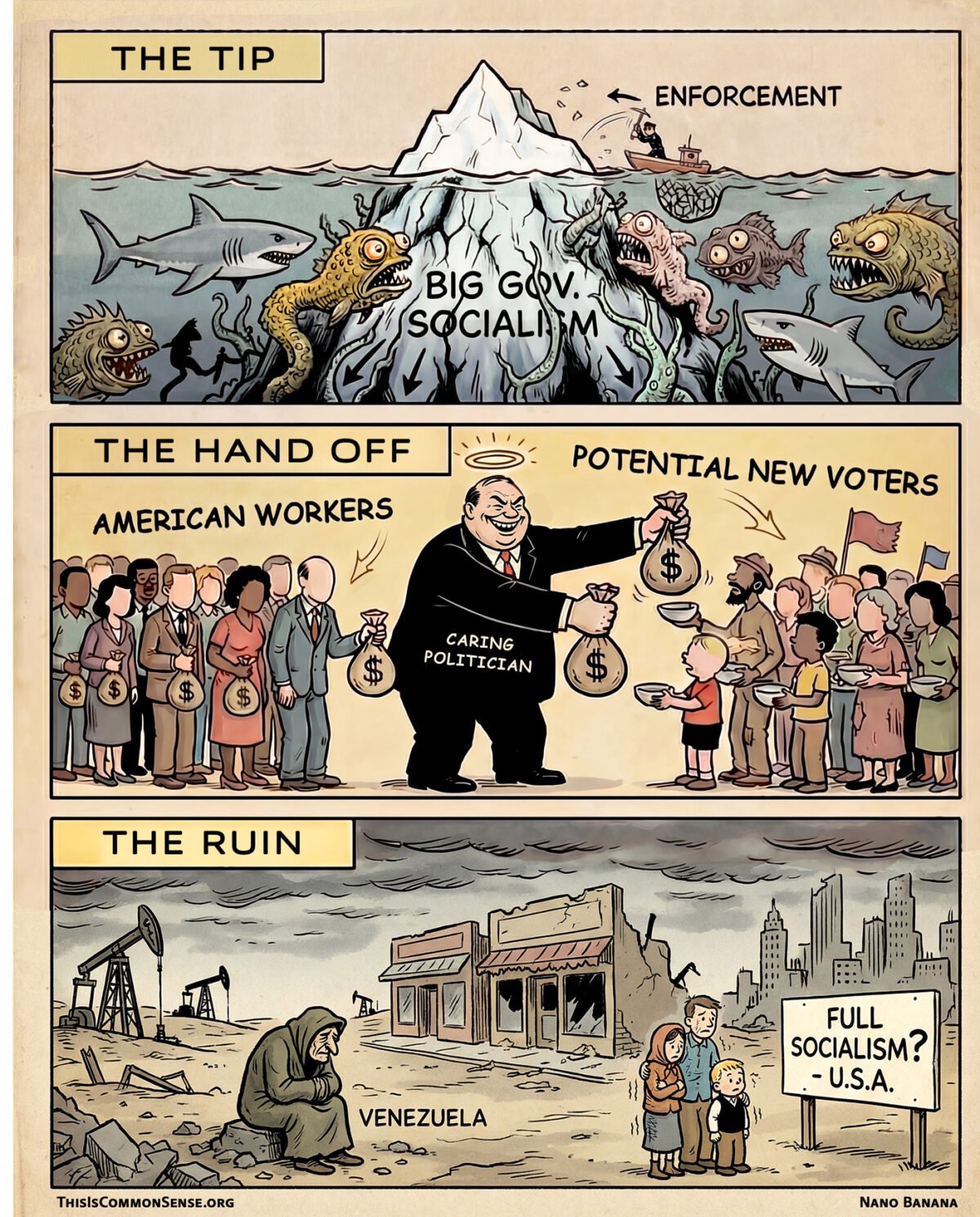

And then she makes a claim that increasing numbers of astute observers make: “That’s only the tip of the iceberg.” She goes on to suggest that Medicare, the Supplemental Nutrition Assistance Program (SNAP), and “many other welfare programs” constitute a huge hunk of fraud.

The solution? “If we want less fraud,” she argues, “we need less government.”

Fraud and big government seem to go hand in hand. At least this kind of big government, which resembles the biggest kind of government imaginable. For taking wealth from many productive American citizens and giving it to a small but growing population of refugees from distant lands, that’s not necessarily fraud, I suppose, but it is something close to socialism.

We see in Venezuela just how devastating rule by thieving socialists can be. (Hugo Chavez nationalized oil industry infrastructure and then ran it into the ground.) In Minnesota and in other states of the union, we see a similar ethic. When done on a limited basis, we could call it “helping the poor,” the folks who just cannot produce what they need. That’s how transfer socialism was sold to us.

And they could say, truthfully, that’s not full socialism.

But extending the beneficiary class from our most needy friends and neighbors to the less-and-less needy, and then to waves of refugees from other countries, that’s a recipe for disaster. Like socialism when “full.”

How far should Americans go to help “others”? To our own ruin?

This is Common Sense. I’m Paul Jacob.

Illustration created with Nano Banana

See all recent commentary

(simplified and organized)

See recent popular posts