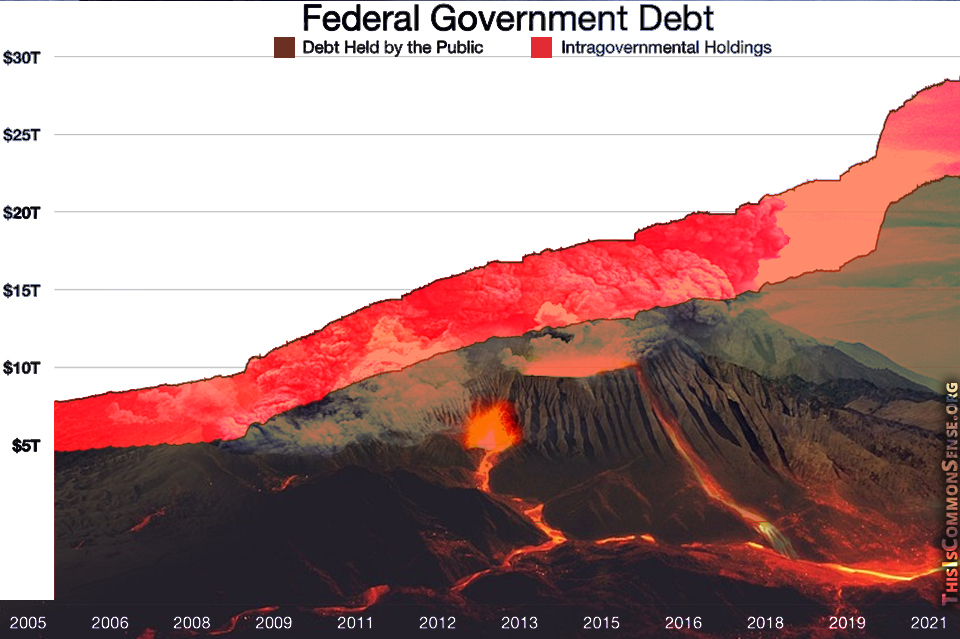

While we were going about our business, and maybe even soaking in some summer sunshine, the “US National Debt,” as the federal government’s explicit financial obligation is called, passed the $37 trillion mark.

As if to mark the occasion, the Chinese government unloaded a whopping eight billion, two hundred million dollars worth of U.S. Treasuries onto the market.

It’s a lot of money.

It’s a lot of debt.

And now China no longer holds it.

Thus they are not quite as invested in our future.

Is that scary?

Well, everything about our federal debt load should scare us. If we are placid and unperturbed now, how many extra billions and trillions would it take to shake us?

If you are especially concerned about world stability, it might make sense to comfort you with this … interesting … piece of information: China still holds over $750 billion in United States debt.

A more important piece of information might be what the Chinese central bank has been replacing the U.S. debt with: gold.

Lots of gold.

About 200,000 kilograms of gold!

Nicholas Nassim Taleb, author of The Black Swan, insists that “a single asset has overtaken the US dollar’s position as the world’s de facto reserve currency.” That asset is gold.

We aren’t on the gold standard, but it looks like we may be falling backwards into something like one.

It makes me wonder if there is still gold in Fort Knox … and just how much.

This is Common Sense. I’m Paul Jacob.

Illustration created with Krea and Firefly

See all recent commentary

(simplified and organized)

See recent popular posts