The prestige of the Nobel Peace Prize has been tarnished by some more-than-dubious awards, in our time … Henry Kissinger and Barack Obama, most obviously.

Same goes for the Bank of Sweden’s knock-off “Memorial” prize for economics.

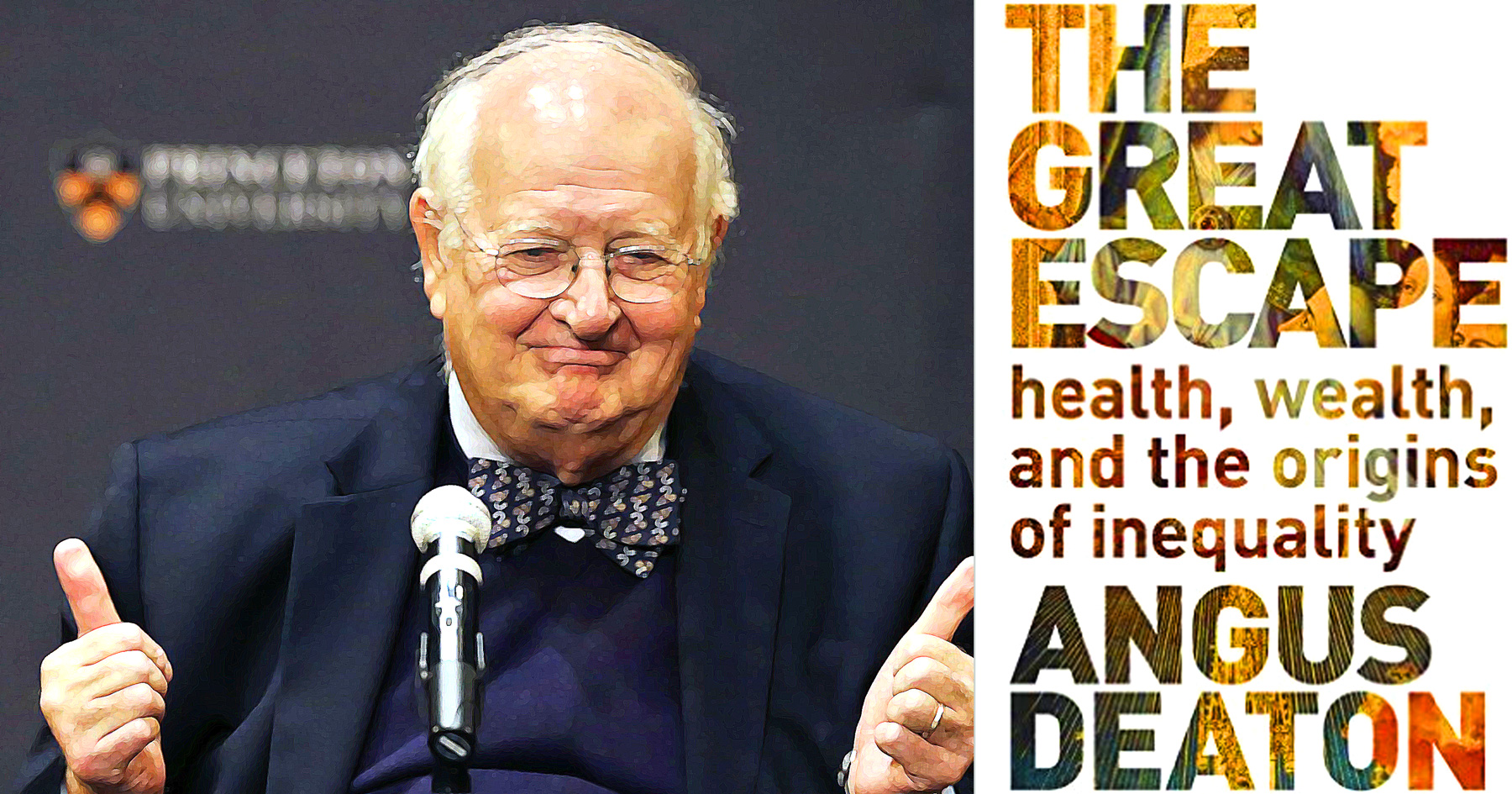

But, according to David R. Henderson, this week’s Nobel nod to Scottish-born Angus Deaton, for his “analysis of consumption, poverty and welfare,” is “a fine pick.”

Deaton is, writes Henderson, “an important chronicler of the market’s abilities to create wealth and improve society.”

While it is all the rage, these days, to complain about increasing inequality, Deaton has been instrumental in showing that wealth, health and welfare have increased as poverty, worldwide, has decreased.

And this has been largely the result of markets. Not big government programs.

Deaton, Henderson tells us, “believes that the approximately $5 trillion given by governments of rich countries to poor countries over the past 50 years has undercut good governance by making poor countries’ leaders less accountable to their own citizens.”

ABC News seconds Henderson’s account:

In his 2013 book, The Great Escape, Deaton expressed skepticism about the effectiveness of international aid programs in addressing poverty.… China and India have lifted tens of millions of people out of poverty despite receiving relatively little aid money. Yet at the same time, poverty has remained entrenched in many African countries that have received substantial sums.

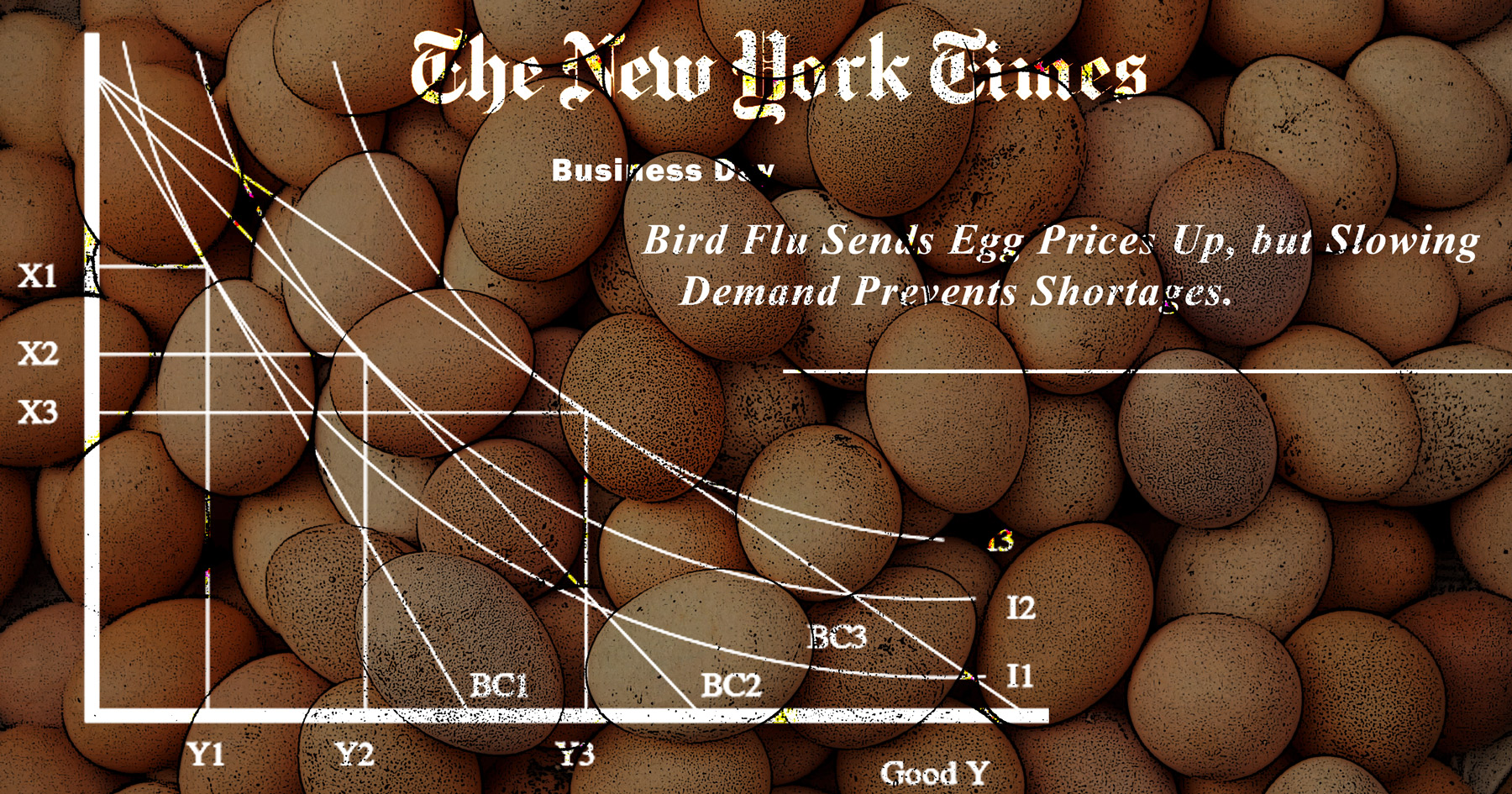

Peter G. Klein, at mises.org, identifies a deeper insight by the latest Nobel economist: “aggregate measures of consumption and inequality conceal important differences among individuals.” This explains why Deaton came to his other (controversial) conclusions: he never took his eye off the real player in market life, the individual.

This is Common Sense. I’m Paul Jacob.