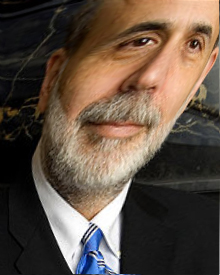

The good news? Federal Reserve Chair Ben Bernanke is getting the boot. The bad news? His replacement looks no better.

Last Thursday, the Senate Banking committee voted to place Janet Yellen as head of the Federal Reserve. The full body of august solons is expected to confirm this nomination, electing her as head honcho and chief cook (kook?) at the nation’s quasi-private/quasi-public central bank.

I am sure there are folks who look on this passing of the baton with a sort of patriotic piety. I know there are Democrats who rejoice in a banker referred to by Reuters as “a monetary policy dove who puts more weight on driving down high unemployment than the risk this will ignite future inflation.…”

Of course, the Fed has already pumped trillions into the system. A burgeoning employment boom has not resulted. To say the least.

Reviewing the current situation, and the likely appointment, economist Gerarld P. O’Driscoll, Jr., reminds us of the big truth about those who push at the Veil of Money: “the Fed is not capable of stimulating job creation, at least not in a sustained way over time.” What the Fed has succeeded in doing, in recent years, is prop up our benighted federal government’s continuing crisis of over-spending: “Congress and the president have been spared a fiscal crisis, and thus repeatedly punted on fiscal reform.”

Problem is, no one really believes debt accumulation or monetary back-up make for a sustainable policy: at some point, O’Driscoll tells us, rising interest rates will “precipitate a crisis.”

I wouldn’t want to be in charge at the Fed when that happens.

So, some sympathy for Ms. Yellen.

This is Common Sense. I’m Paul Jacob.