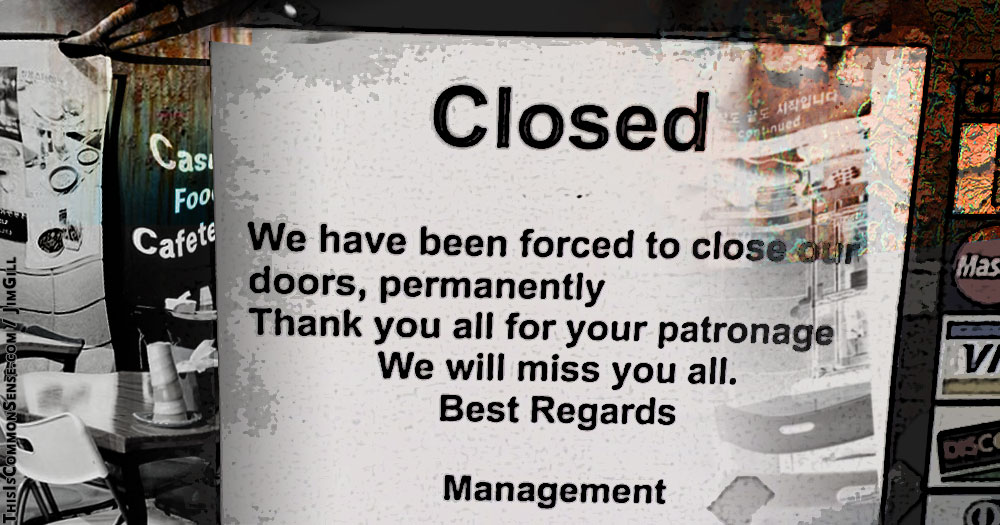

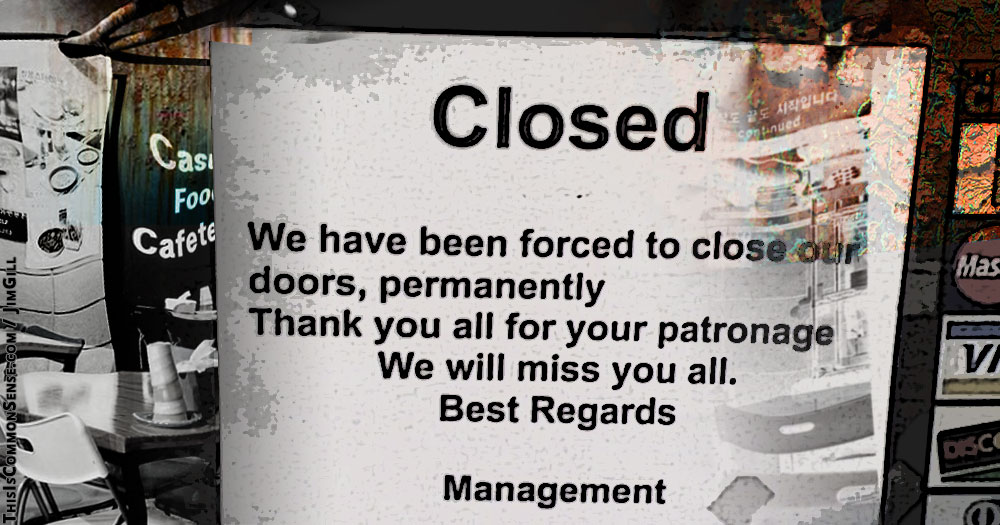

It should shock no one: forcing businesses to pay steep minimum wages ends up pushing some businesses out … of business. Yesterday I looked at what minimum wage laws can do to low-skilled workers. Today, consider the employers. When we make it harder to turn a profit, it becomes harder to profit. Businesses that can’t at least break even close their doors.

Many business owners are inclined to promote, politically, politicians who in turn support minimum wage hikes. Do they change their minds when mugged by reality? Alas, the trauma alone won’t convert a person to principled allegiance to free markets.

I was reminded of this fact by a story about business owners in Minneapolis who stress their Sandernista credentials.

“I’m a bleeding-heart liberal and I’m a big Bernie Sanders supporter,” says businesswoman Jane Elias, an art store owner. “But this whole flat-out, $15, one-size-fits all is just wrong.” Another victim, restaurant owner Heather Bray, says she’s a “proud, proud progressive.” But: “The arithmetic doesn’t work. People will not continue to go to budget-conscious restaurants when they’re no longer budget-conscious.”

So … arbitrary minimum-wage demands don’t add up in light of the demands of running their businesses under their particular circumstances. Well, no disagreement here. But take it further, please. Keep doing the math. The bottom line is that everybody, not just you — and always, not just sometimes — has the right to make his own decisions about his own life and property.

And profit by it.

This is Common Sense. I’m Paul Jacob.