Just-retired Scot Peterson is a millionaire, thanks to the generous taxpayers of Broward County, Florida.

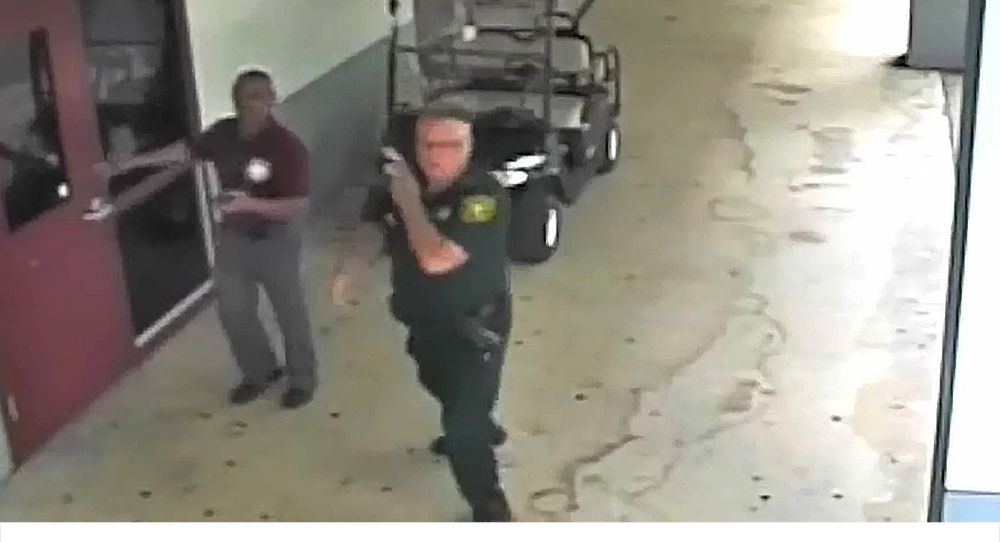

You know Peterson as the sheriff’s deputy assigned to protect students at Marjorie Stoneman Douglas High School, who, instead of entering the building where the shooter was mowing down 17 unarmed students and teachers, protected himself by waiting outside.

Peterson claimed “he remained outside the school because he didn’t know where the gunfire was coming from,” noted BuzzFeed. But “[r]adio transmissions from the day of the shooting have since contradicted Peterson’s defense …”

Following the cowardly non-performance of his duty, Peterson promptly retired and began drawing his pension. As the Sun Sentinel newspaper reported Tuesday, his monthly check is for $8,702.35 — an annual salary of $104,428.20.

Should the 55-year-old live to the age of 75, he’ll draw more than $2 million.

In fact, the cowardly Peterson is being further rewarded with a $2,550 annual raise — earning more in retirement than he was earning while actually working.

I use the word “earning” and the phrase “actually working” loosely.

Reacting to the news, the father of one of the murdered students called Peterson’s lavish pension “disgusting” and “outrageous.”

Recoil at the thought of this derelict policeman raking in such mega-moolah during decades of retirement — but that isn’t the only outrage.

How can Broward County afford to pay even their bravest police officers millions of dollars in retirement?

They can’t … for much longer.

Regardless, elected officials dare not do anything about it. They fear incurring the wrath of public employee unions … and risking their own pension windfalls.

This is Common Sense. I’m Paul Jacob.