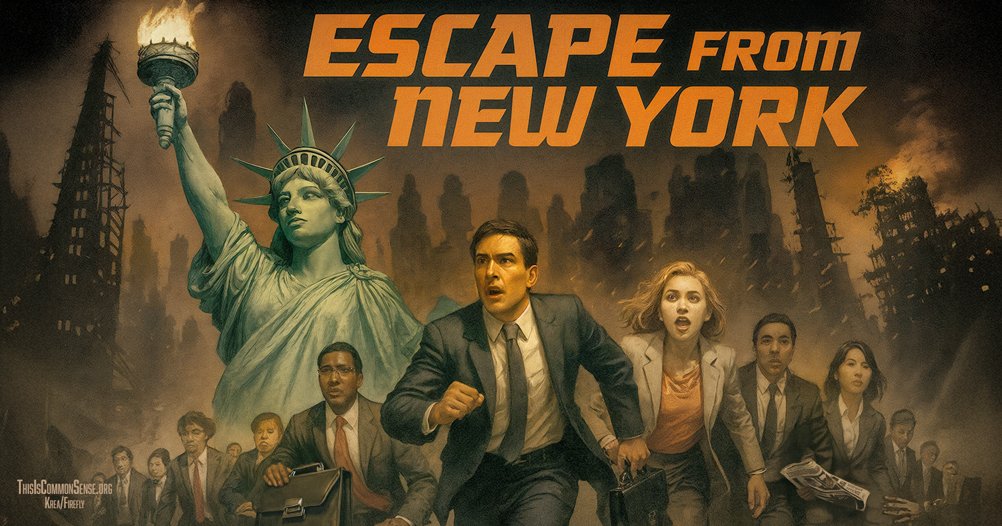

People in New York City with any money and property are unhappy about the prospect of a communist mayor. They apparently see the potential of the government taking much more of their money less a politician’s promise and more a revolutionary threat.

While Zohran Mamdani might lose, it’s not looking that way. (Note the standing of his chief competitor.) Therefore, many homeowners are fleeing, without waiting for Election Day.

One destination is next-door Connecticut, site of a failed revolt in 1991 against the enactment of a state income tax. New Yorkers reasonably suppose that the taxes imposed by a Mayor Mamdani would prove worse than that — and worse than New Yorkers’ already-heavy tax burden.

Escapees are also worried about crime.

Mamdani could do much unilaterally but would need the cooperation of the state legislature and governor or the city council to impose the tax hikes he’s dreaming about. Still, these entities hardly serve as bulwarks of limited government.

We know that New Yorkers are lurching to Connecticut because, as the New York Post reports, a “bidding war frenzy and soaring prices” have hit the state’s housing market.

According to real-estate agents there, the frenzy resembles that of early pandemic times. Properties are being scooped up within days. Deals are cash on the barrelhead, even for multi-million-dollar homes. Sale prices are much higher than expected.

And the bidders are coming “out of New York City,” the agents say. Prospective buyers have been “mentioning concerns about the mayoral election.…”

Good news, for a while, for Connecticut home sellers and their real-estate agents. Bad news for everybody else, soon enough.

This is Common Sense. I’m Paul Jacob.

Illustration created with Krea and Fireflly

See all recent commentary

(simplified and organized)

See recent popular posts