Bernie Sanders is worse than merely wrong about the rich not paying their fair share of taxes.

It’s we, the much-lauded “Ninety-nine Percenters,” who don’t pay enough!

At least, when we figure taxes paid against direct subsidies/services rendered: taxes minus transfers. And, according to the Congressional Budget Office, only the top quintile of income earners — including the much-abhorred One Percenters — pay appreciably more in taxes than they receive in “benefits.”

In a republic, you would expect the masses to pay taxes, receiving only indirect benefits, like a broadly defined “security” and “the rule of law.”

The calculation of who is and is not a net tax-payer or net tax-consumer has to be difficult. I certainly haven’t vetted the studies carefully. But previous accountings also show that the super-rich pay the bulk of income taxes in America.

How to put the system aright?

Don’t tax us more!

Bernie’s preference, to tax a whole lot more as well as to provide more subsidies and “benefits,” will only make a bigger mess.

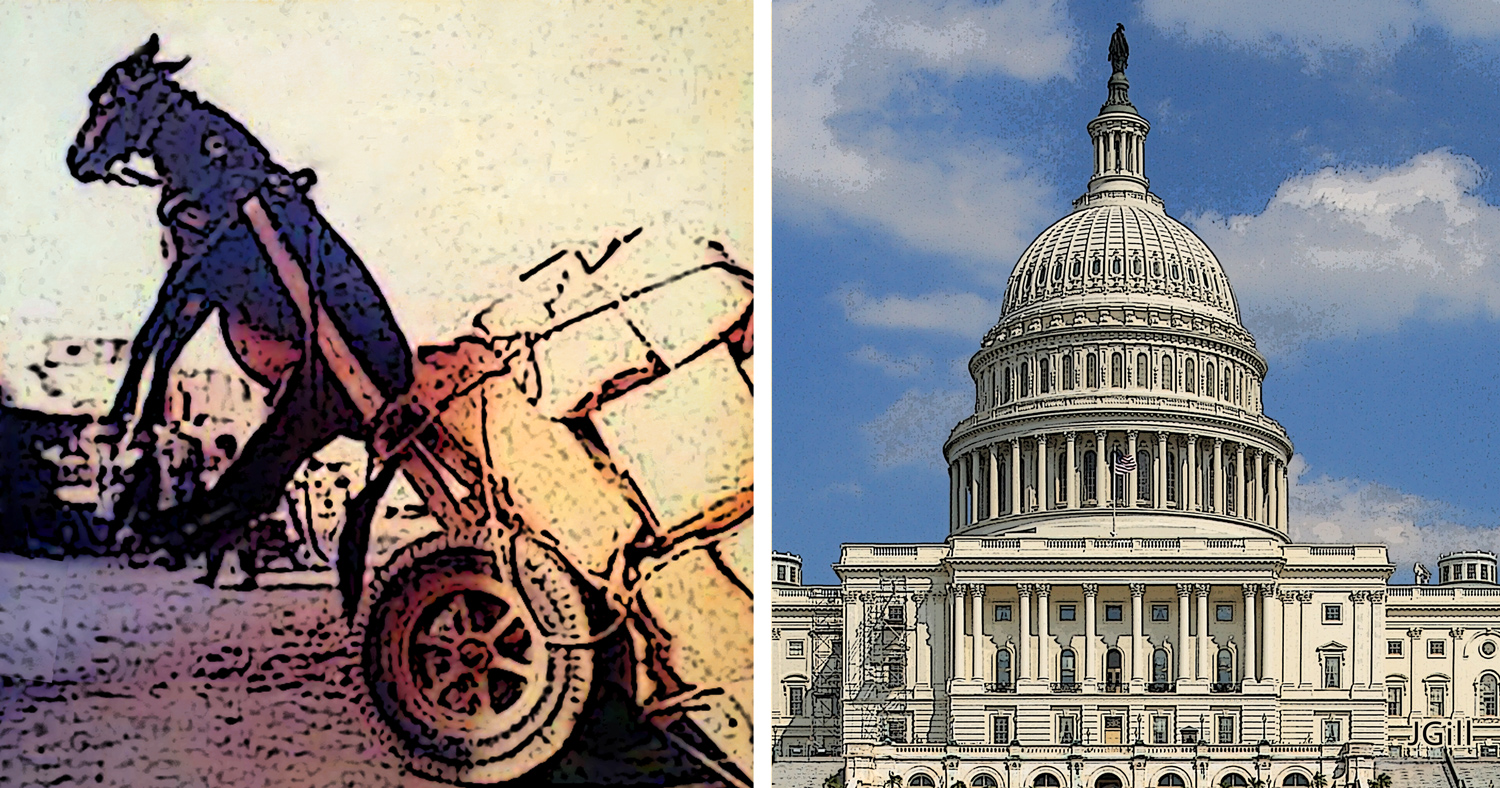

Unfortunately, doing the right thing (cutting back on the giveaways at all levels) is politically . . . tricky.

But there’s something missing in all this: the indirect hazards of the “benefits” . . . the opportunity costs involved when we get hooked on hand-outs. The most trapped people in America are those who pay the least and take the most. The dollar-value of their received transfer payments measure neither their dependency nor their consequent lack of upward mobility.

How could we figure real harms and helps embedded in the current system, when some “benefits” are, in fact, detriments?

This is Common Sense. I’m Paul Jacob.