There are times I wish I were a tax accountant.

You know, just so I could better understand the news.

The European Commission has handed Apple, Inc., a $14.5 billion tax bill.

Owed to Ireland.

Apple, the tax commissioners said, had paid too little in taxes to Ireland, amounting to a mere 1 percent of the company’s European profits.

The Emerald Isle’s normal corporate tax rate is 12.5 percent.

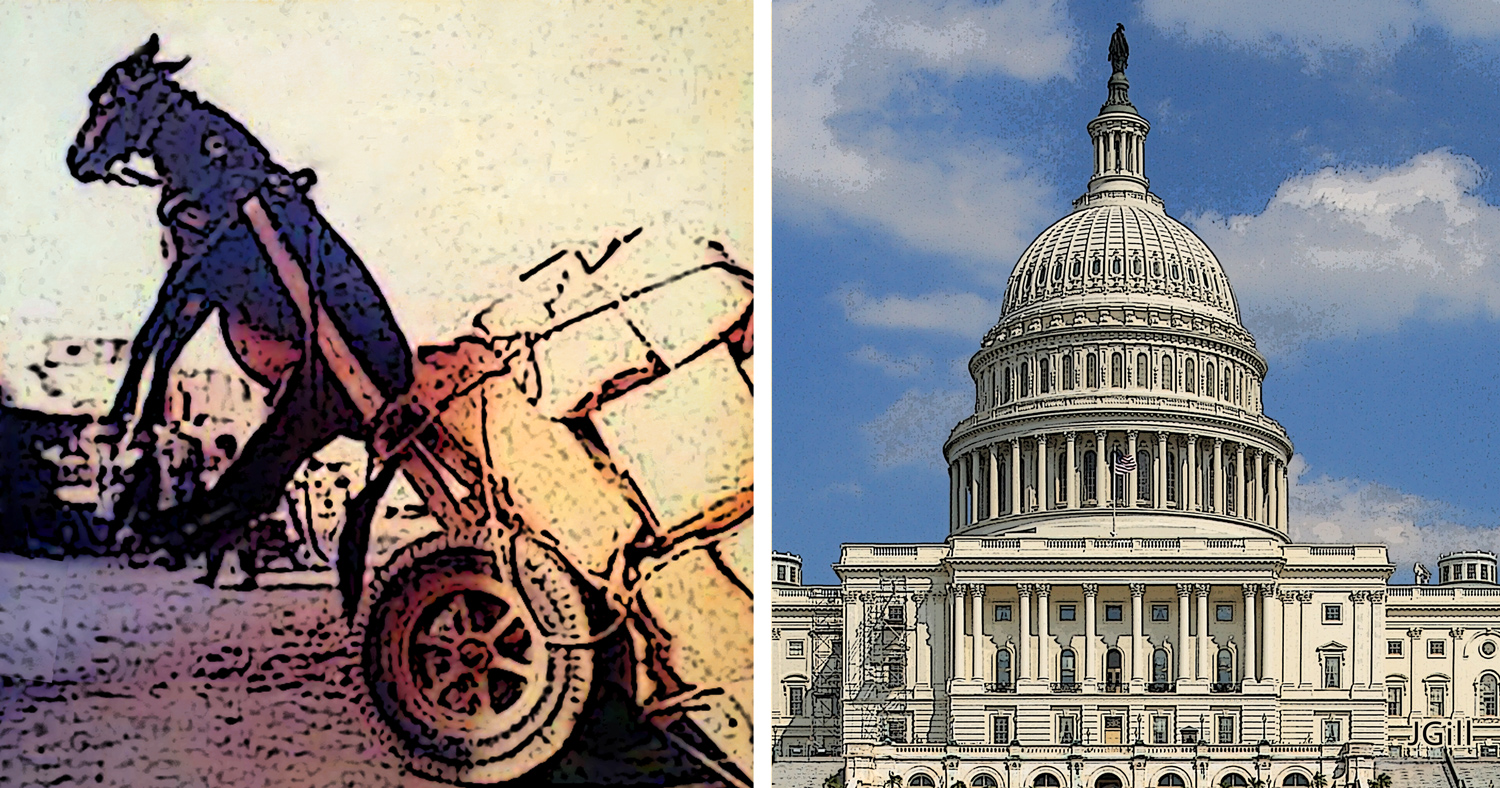

On first read, this sounded like a tale of crony capitalism, with the EU’s tax authorities riding in, heroically, holding aloft the gonfalon of fair play, on the side of truth, justice, and an even playing field.

Well, the story gets complicated. The U.S. Treasury has protested the ruling as unfair. And Senator Chuck Schumer called it a “cheap money grab.”

The Wall Street Journal opinion page comes out on Apple’s side, too, but gives some specifics. Apple paid all the taxes it owed under Irish and EU law, but the ruling wasn’t about law, it was, we are told, about politics.

I can believe that.

So, as near as I can make out, what we have here are three sets of governmental interests, each intent on sucking the most out of a rich, innovative, and wildly successful multinational corporation.

It’s hard not to side with the target, Apple, and think of the other groups as mere parasites.

After all, my non-accountant’s spidey sense suspects that Schumer objects because the U.S. government isn’t going to get any of that $13 billion.

Preferring an “expensive money grab,” I suppose.

This is Common Sense. I’m Paul Jacob.