The courts have not been kind to President Joe Biden’s unilateral attempt to erase some $200 billion to $500 billion in student-loan debt. (By “erase” I mean force all taxpayers to pay debt incurred by the millions of borrowers eligible for the forgiveness program.)

Last month, a federal judge issued a temporary stay on the program while the litigation plays out.

On November 10, another federal judge, Mark Pittman, ruled that the program is a “complete usurpation” of congressional authority. Per Pittman, the U.S. is “not ruled by an all-powerful executive [but] by a Constitution that provides for three distinct and independent branches of government.”

In consequence, the Biden administration stopped accepting applications for student-loan debt relief. By then more some 26 million borrowers had applied.

On November 14, another federal court also blocked the program. So Biden’s debt-transfer plan is apparently at least thrice bogged down.

Except that another student-loan-debt-erasing thing has been going on since early in the pandemic, a pause on debt payments rationalized by the economic hardship imposed by lockdowns.

This pause was set to lapse at the end of this year, with payments to resume in January. But according to a White House insider “familiar with the matter,” the administration has been making “increasingly firm plans to extend the repayment pause.”

The pause also costs taxpayers money. The original rationale for it no longer exists. Like the mega-debt-relief program, extending the pause would also be unconstitutional.

This subsidy is also unlikely to inspire kindness from the courts.

This is Common Sense. I’m Paul Jacob.

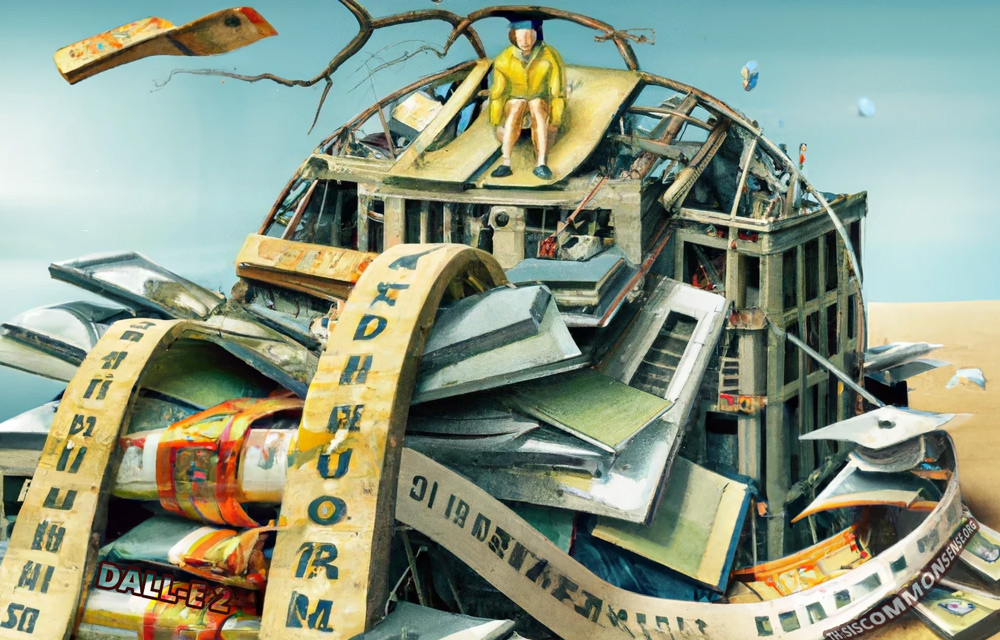

Illustration created with DALL-E 2

—

See all recent commentary

(simplified and organized)

7 replies on “One Way or Another or Another”

A great many things done by Congress or by a President have been done with an expectation that the US Supreme Court would reverse things, so that the politicians could claim that they had tried their best, without the damaging consequences actually following. But we cannot always count on the Supreme Court. Sometimes they wave-through things that the Congress and the President really want the Court to stop.

Some part of the Biden Administration has probably been counting on the Court to stop the huge redistribution of wealth in compelling taxpayers to pay-off student loans. (As to Joe Biden himself, I don’t know what thoughts on this matter move through what remains of his mind.) But if the Court for some reason does not, then the political cost to the Administration of reversing itself ensures that we will be stuck with the programme.

The Courts have routinely allowed unconstitutional acts by Congress or POTUS to stand. The Supreme Court figured out a justification for the individual mandate in Obamacare. DACA and DAPA are clearly illegal, since they go against the immigration laws passed by Congress. Donald Trump tried to rescind those EOs but was blocked by the court. For the most part, the Courts stood by while Barack Obama used his pen and his phone. I don’t hold out hope for the Supreme Court to make things right. They’d rather stay neutral than risk the backlash by radicals.

Did “you” gripe when Trump increased the debt by $4 trillion?

“President Trump’s $4 Trillion Debt Increase

JUL 25, 2019 BUDGETS & PROJECTIONS

If the recent budget deal is signed into law, it will be the third major piece of deficit-financed legislation in President Trump’s term. In total, we estimate legislation signed by the President will have added $4.1 trillion to the debt between 2017 and 2029. Over a traditional ten-year budget window, the President will have added $3.4 to $3.8 trillion to the debt. The source of the debt expansion is split relatively evenly between tax and spending policy.”

Covfefe!

Why in the world did you put “you” in quotation marks?

We did object to Trump’s level of spending. We also objected to Trump’s trade policies, which involved selective transfers to firms that otherwise faced greater foreign competition. However, as I explained in a comment below, tax-cuts are not give-aways. Treating them as such involves a pretense that the state owns everything, and thus that what it does not tax it gives.

In the case of state-effected or state-sponsored loans, the borrowers did not start-out as the owners of the funds.

“For the wealthy, banks, and other corporations, the tax reform package was considered a lopsided victory given its significant and permanent tax cuts to corporate profits, investment income, estate tax, and more. Financial services companies stood to see huge gains based on the new, lower corporate rate (21%), as well as the more preferable tax treatment of pass-through companies.

Some banks said their effective tax rate would drop under 21%.”

A Trump giveaway to the wealthy!

The notion that a tax cut simply is a subsidy (a “give-away”) is absurd.

“To treat a tax-cut as morally equivalent to a subsidy, or to do as so many ‘progressives’ and left-wing populists — to insist that a failure to increase some tax on some party to a prior or even new level simply is a subsidy — is to insist that the state is morally entitled to tax at the greater level, that the state owns those resources.”

(Follow the link for a more complete discussion.)

If you look closely at the Constitution, the word supreme in supreme Court is not capitalized.

Maybe that was done for a reason.