Unless you’re the customer. Then it’s okay.

Once upon a time, the warning that now reads something like “Under penalty of law this tag is not to be removed except by the consumer” did not include those last four words.

The original wording has been the occasion of much not entirely genuine concern about the prospect that officers of the law will invade the homes of unruly tag-rippers. These renegades were celebrated in song by science fiction writer, libertarian, and singer L. Neil Smith. (You’ll find the lyrics in his novel The Wardove.) More famously, Chevy Chase, in the movie Fletch (1985), bluffed his way out of a tight spot pretending to be concerned about mattress tags.

But if you’re a company selling something with a tag, removing it can be deceptive. Especially if you remove it in order to replace it with another tag that gives customers a very mistaken idea about the product you are selling.

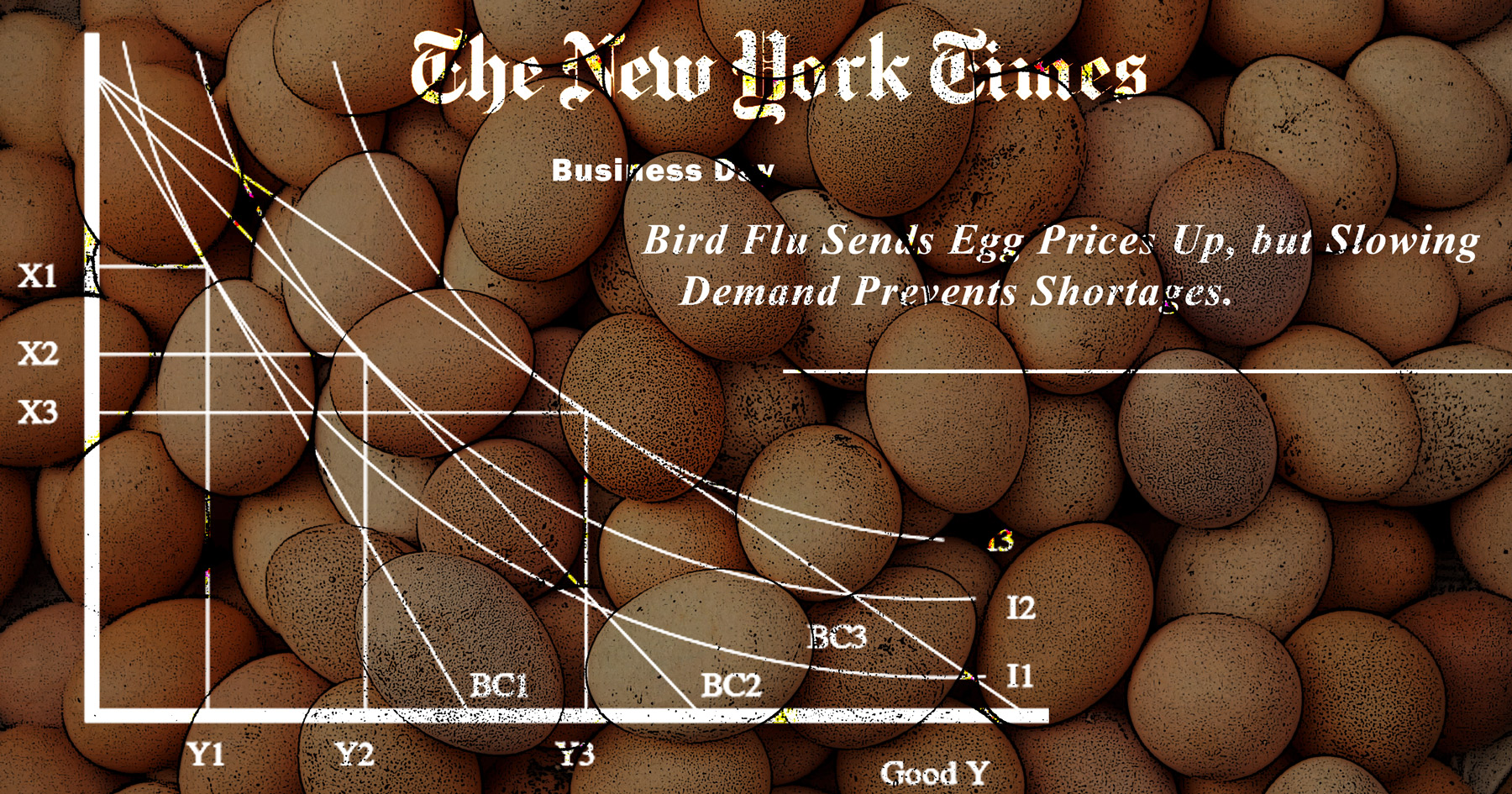

Such a fraud has apparently been committed by a company called Lions Not Sheep, which caters to lions (leaders). The company removed tags saying Made in China from clothing that it sells and replaced them with tags saying Made in USA. For this, the FTC fined the firm $211,335.

Lions Not Sheep understands its market.

Yes, when buying stuff, many people hope to avoid directly or indirectly supporting the Chinazi government to the extent possible. These folks create a substantial demand for goods made not in China but in America (or in other acceptably non-totalitarian countries).

But defrauding the buyer is, of course, not the way to meet this demand.

This is Common Sense. I’m Paul Jacob.

See all recent commentary

(simplified and organized)

See recent popular posts