There’s an old saying — some say it’s an ancient “Chinese saying,” but I first heard it attributed to an Indian philosopher — to the effect that “the best time to plant a tree is thirty years ago; the second best time is today.”

Eric Boehm, writing in Reason, riffs on it regarding federal spending: “The best time to stop borrowing heavily was yesterday (or several years ago), but the second-best time would be today. Instead, Congress is likely to make this problem even worse — again — by continuing to spend like there’s no tomorrow.”

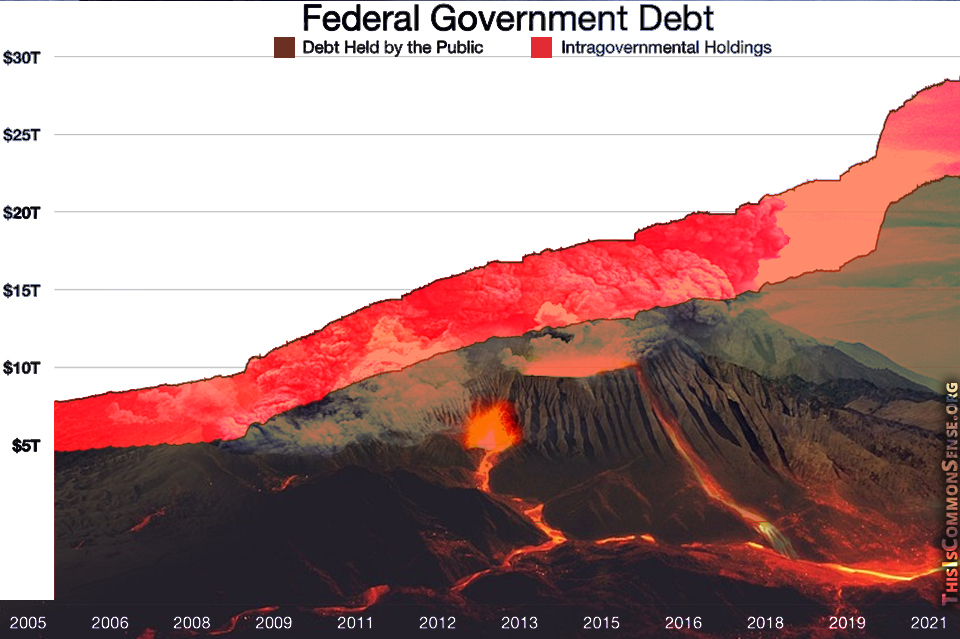

In November, the federal government ran a $249 billion deficit, which, Boehm informs, is up $56B from the previous November.

Talk about November chills.

But worse yet is that Congress is gearing up for more. The omnibus spending bill in the works “will add between $240 billion and $585 billion to this year’s budget deficit.”

After a lifetime of deficit spending, this may seem only worth a furrow above the eyes, not an actual arched brow. But it does make a mockery of President Joe Biden’s boast of decreasing deficits on his watch. As Boehm explains, that’s merely an artifact of the Trump Era humungoid pandemic giveaways. There had to be some sort of let up from that binge. Nevertheless, the “underlying figures showed all along that the deficit situation was continuing to worsen, and that President Joe Biden’s policies were adding trillions of dollars to the deficit over the long term.”

It’s almost as if they think “money grows on trees.”

Would that it were the case, though, since there are only a limited number of trees. Taxation and especially debt are, to politicians, closer to infinity.

This is Common Sense. I’m Paul Jacob.

Update: Senator Mitch McConnell said, yesterday: “I’m pretty proud of the fact that with a Democratic president, Democratic House, and Democratic Senate, we were able to achieve through this Omnibus spending bill essentially all of our priorities.” The Republican Leader predicted passage on the 22nd.

Illustration created with DALL-E2, John Tenniel, Thomas Cole, JG

—

See all recent commentary

(simplified and organized)