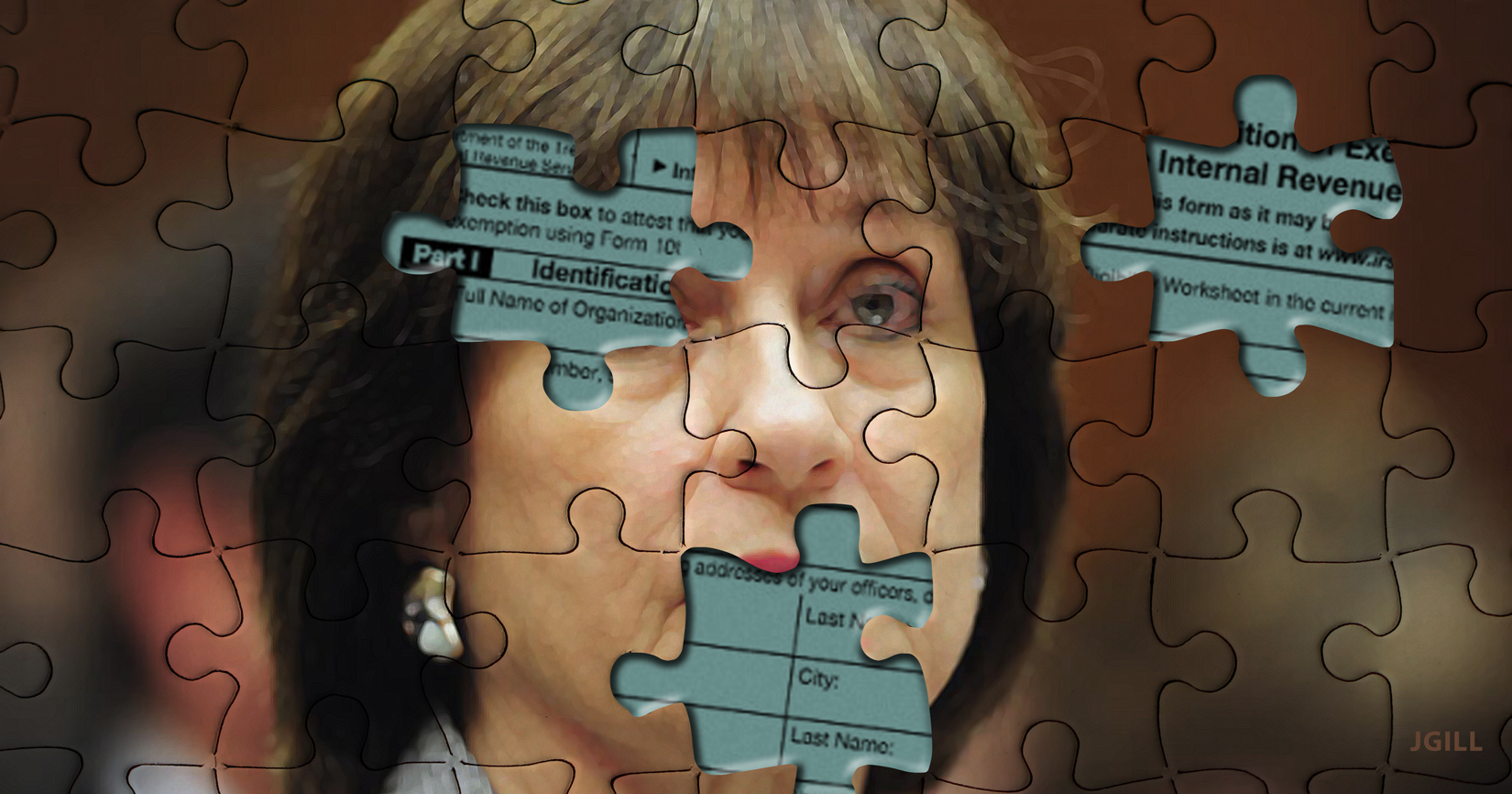

Is it time to spell out the IRS as the Internal Revenue Scandal?

The IRS has so many scandals under its belt.

But the biggest, from a broad, threat-to-the-republic point of view, surely remains the agency’s targeting of Tea Party and conservative organizations seeking 501c(3) and 501c(4) nonprofit status. Agents ideologically tagged their applications for special obstruction in the run-up to the 2012 presidential campaign. And after.

I don’t bother Googling to get my IRS-scandal updates, I just visit the indefatigable Paul Caron’s TaxProf Blog. Day in, day out, for the past 700+ days and counting, TaxProf has aggregated all the latest reportage and analysis about this abuse of power.

Lois Lerner — former head of the IRS’s stomp-conservative-nonprofit-applicants division — has both declared herself innocent of any wrongdoing and asserted her Fifth Amendment right not to incriminate herself.

But evidence is piling up of her actual attitudes and what-she-knew-when.

TaxProf points to an email by Lerner from way back in February of 2012 in which she advocates training for IRS staffers in the fine art of “understand[ing] the potential pitfalls” of providing too much information to Congress. A 2013 email by Lerner states that she can understand “why the IRS criteria” leading to the targeting of Tea Party and other groups “might raise some questions.”

The documents are out in the wild now, thanks to Judicial Watch’s Freedom of Information Act requests. JW has been relentless in trying to hold the IRS accountable.

Which has to be one of the very toughest jobs on earth.

This is Common Sense. I’m Paul Jacob.