“Wait, it gets worse.”

Over halfway through Eric Boehm’s Reason discussion of our government debt situation, he gets to a crucial point: “The federal government’s debt is particularly susceptible to rising interest rates . . . because so little of it is locked into long-term interest rates. If you have a 30-year fixed-rate mortgage on your house, rising interest rates won’t bother you much. But the federal government overwhelmingly relies on short-term debt, with an average maturity time of just 69 months.”

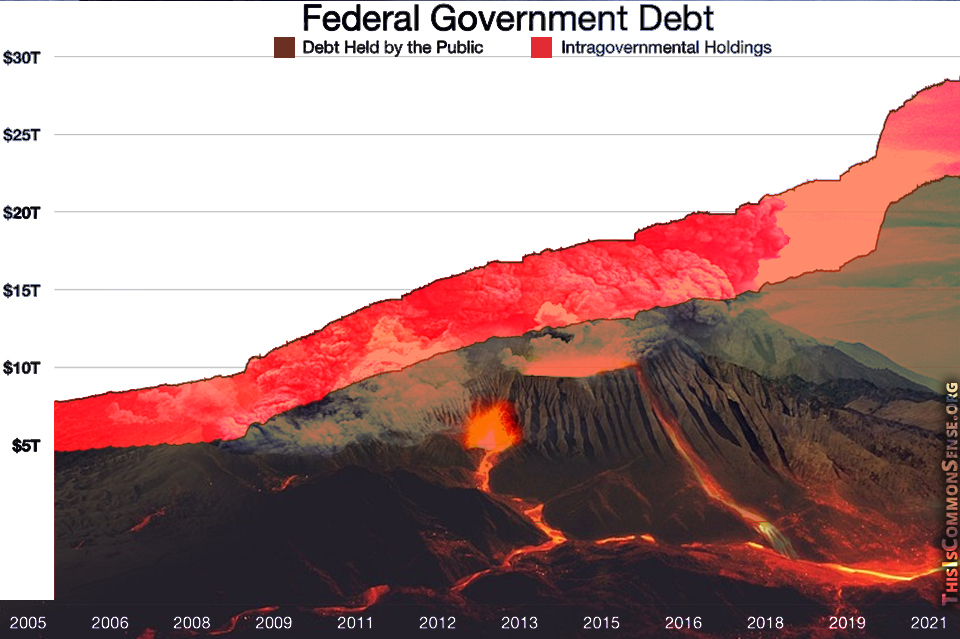

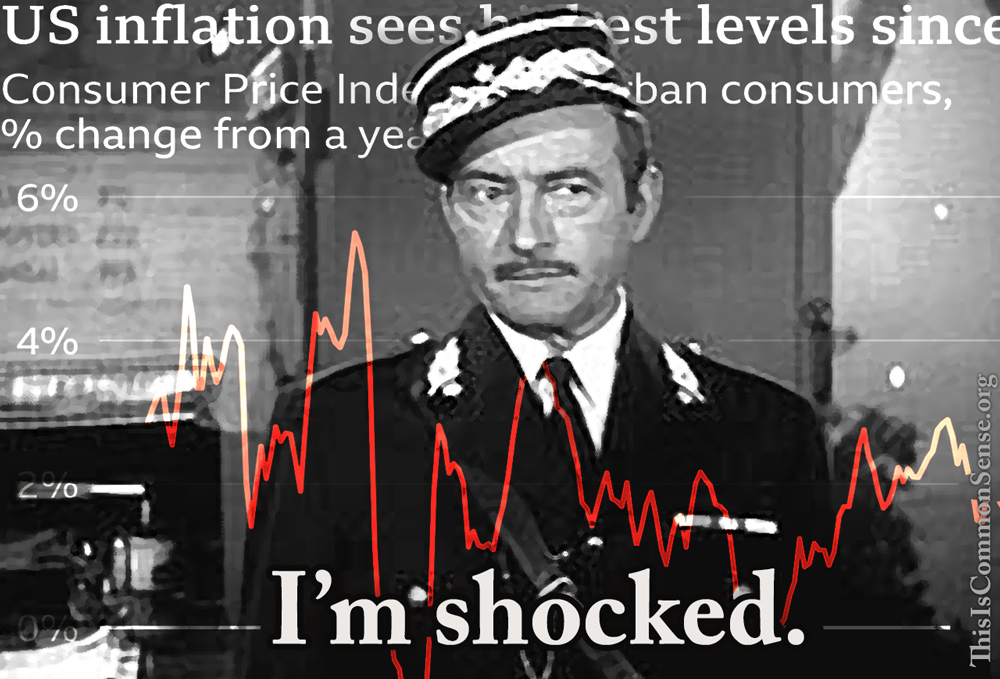

So the standard approach to inflation, with the Federal Reserve raising interest rates, would hit the federal budget like an exploding volcano.

When talking trillions, it’s hard to keep a sense of proportion. Boehm puts it this way: “A one percentage point increase in interest rates translates into a $30 trillion increase in interest costs.”

Debt service is one of the reasons why the sages at the founding of America were, if not united in opposition to federal debt, overwhelmingly leery of it. But that leeriness did not stop federal borrowing. Only for one brief moment did the United States’ government not hold debt.

Borrowing was one thing when gold or silver fettered our finances to some limits. But paper and digital money have divorced us from a sense of reality.

We pretend that debt’s reality can be perpetually postponed, but we always “pay” — in lost prosperity; in inequality; in economic dislocation; in political unrest. But when the volcano erupts, then we really pay.

As we awake to our indebtedness, let’s recognize that our political culture has allowed it to get so far out of hand. Fundamental political reform is imperative.

This is Common Sense. I’m Paul Jacob.

—

See all recent commentary

(simplified and organized)