Rumors that Washington Post owner Jeff Bezos has been pushing the Post in a more commonsensical editorial direction could very well be true.

A recent Post editorial slams progressives who “think of taxation the way teenage boys think about cologne: if some is good, more must be great.”

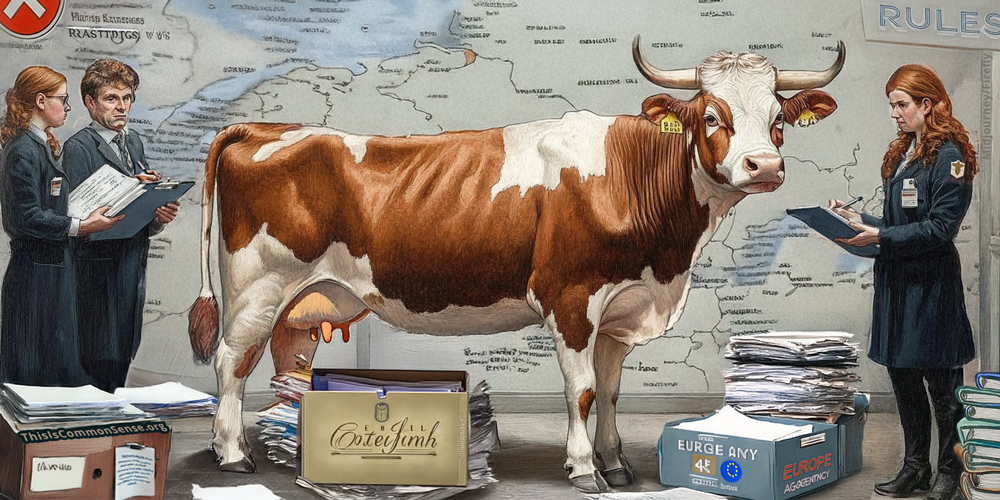

I’m no fan of even a moderate amount of that brand of cologne. But anyway. The Post is discussing a proposed ballot measure backed by the ultra-lefty Service Employees International Union.

SEIU troops are currently collecting signatures. And before they’ve even gotten enough to post it to ballot, the people being targeted have started moving.

Out of state.

The measure would impose a new 5 percent tax on billionaires. Some of the state’s billionaires, including Google cofounder Larry Page and Palantir cofounder Peter Thiel, aren’t willing to wait and see whether it actually reaches the ballot and passes in November. Why? The measure would apply retroactively “to those who were California residents on January 1, 2026.”

Some Democratic lawmakers are saying “good riddance,” as if it’s possible to loot billionaires who don’t wait around to be looted. Or that it’s good for state coffers to lose their billionaire entrepreneur “contributors.”

The Post says the retroactivity would open the measure to legal challenges, but that if it gets passed and survives litigation, “it’s a safe bet this won’t be a one-off. Funding ongoing expenses like health care with one-time taxes isn’t sustainable. Progressives will want to return to the well until they’ve sucked it dry.”

And no one should know better than Californians how dangerous dry wells are.

This is Common Sense. I’m Paul Jacob.

Illustrations created with Nano Banana

See all recent commentary

(simplified and organized)

See recent popular posts