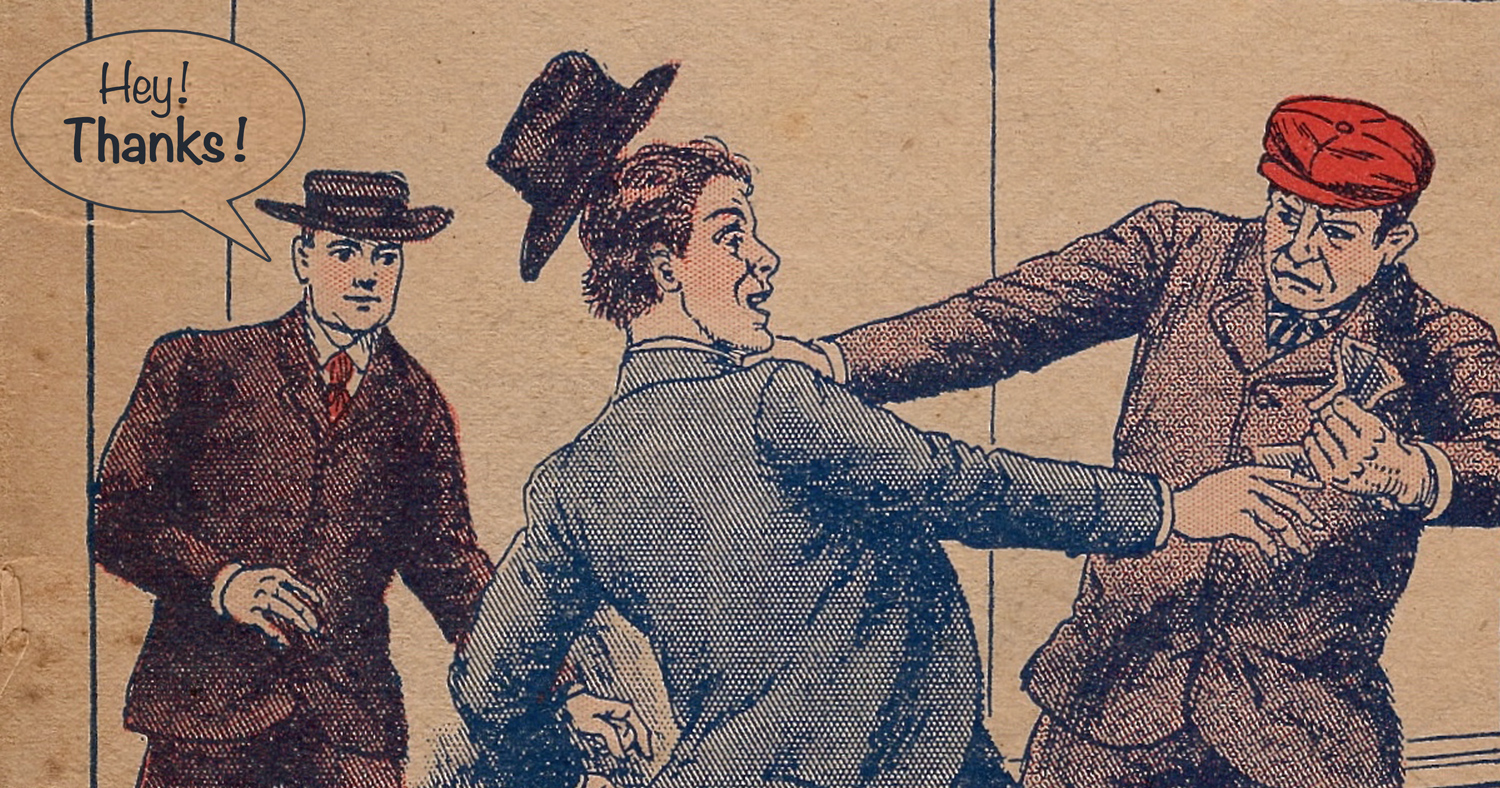

Say a mugger robs Ed instead of you. Has the mugger given you a present of your stuff by not taking it? Is his non-taking a “giveaway”?

No. If you possess something you have honestly earned, it is yours by right, not as a special gift from each person who abstains from relieving you of it.

Why is this not just as true when the prospective stuff-taker is a government?

Whatever case may be made for taxing you to fund a governmental goal, the state is not “giving” you whatever part of your wealth it lets you keep.

Yet this is the claim that partisans of big government repeatedly make. They apparently aim to undermine any hint of willingness to let us keep more of what belongs to us.

We see it again in the context of President Obama’s recent attacks on the plan of some Republicans to do away with estate taxes, the notorious “death taxes.” This tax relief would allegedly be a “giveaway” to those who have worked most successfully to earn something worth leaving to people they care about. It would also allegedly “deprive” non-recipients of some government handout no longer fundable because of the tax cut.

Being taxed less is always about keeping more of your own money and being able to spend it as you wish, including on heirs.

That’s a feature of tax cuts — not a bug.

This is Common Sense. I’m Paul Jacob.