Five years into (the latest phase of) the Greek debt crisis, a former bureaucrat who was unable to withdraw her money from an ATM when the government declared a bank holiday had this to say: “How can something like this happen without prior warning?”

It’s always a surprise — to some people — when blatant causes lead to blatant effects.

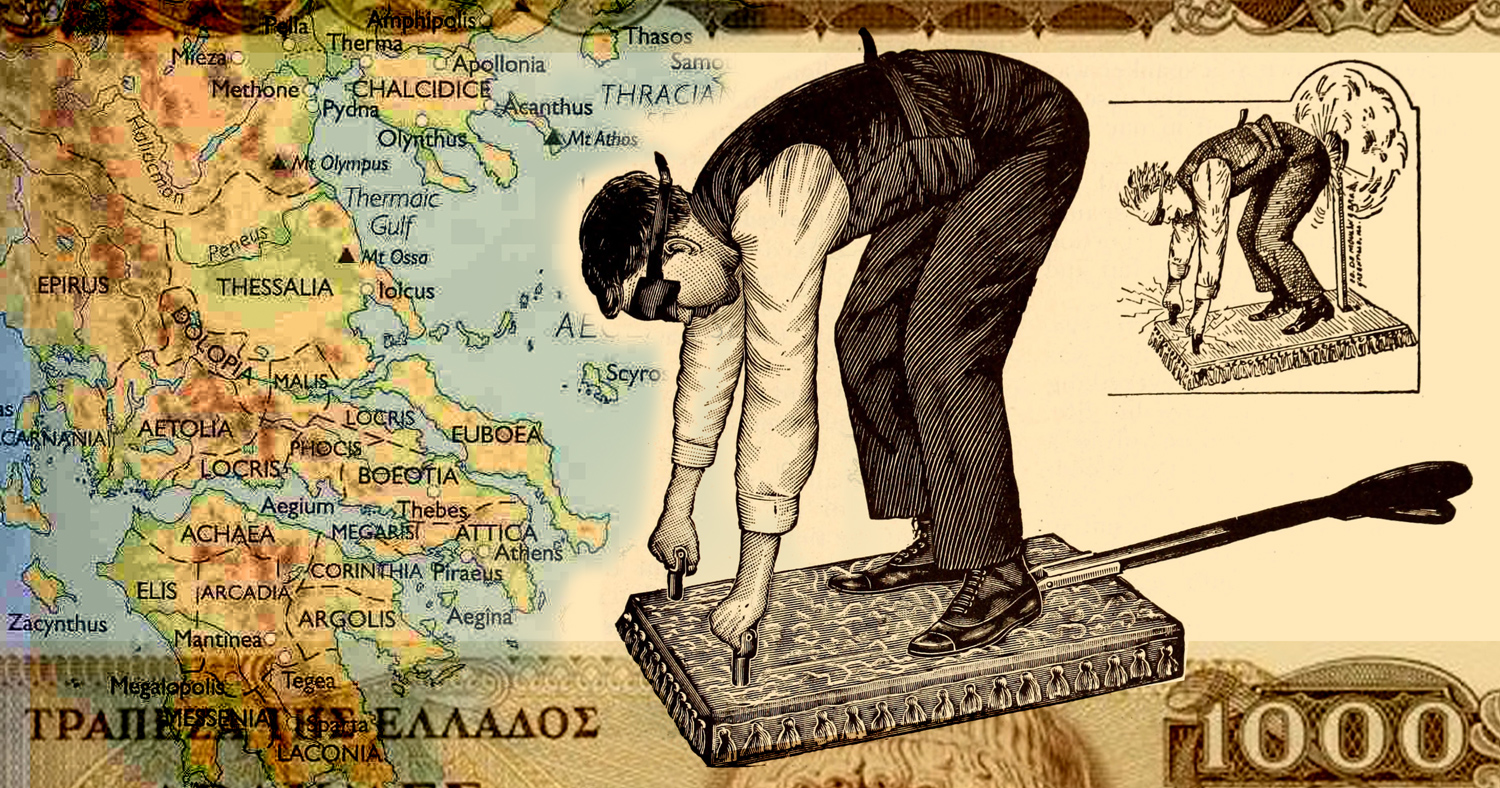

In the case of Greece, or any socialistic welfare state, it’s a surprise when the money finally runs out. So accustomed to binge behavior, enthusiasts for “what’s thine’s mine” and “spend now/pay later” politics are nonplused when there’s nobody left to temporarily rescue them from the worst wealth-destroying effects of all the productivity-destroying causes.

The woman’s question has a short-term answer and a long-term answer.

The first is: what did you expect? The point of suspending access to bank accounts without warning is to stop holders draining banks of the last of the euro cash, supply of which the Greek government cannot expand unilaterally. Warning would have made the suspension pointless.

The second answer is: what did you expect? That is, haven’t you been paying attention for the last several decades?

By the time you read these words, Greece and the European governments may have come up with another patchwork deal for a loan with another series of deadlines. Or maybe Greece will have left the EU or at least the euro and returned to a (now massively inflated) drachma. Greek account-holders may or may not get another rickety, temporary reprieve.

But what can’t go on forever, won’t.

So it won’t.

Count on it, ma’am.

This is Common Sense. I’m Paul Jacob.