It turns out the United States is a tax haven.

Haven? Heavens! I live here. I don’t feel that low-tax feeling when April 15 rolls around.

But the Cato Institute’s Dan Mitchell, an expert on all things tax-policy — a dirty job, but somebody’s gotta do it — says “The U.S. Is a Tax Haven … and That’s a Very Good Thing.”

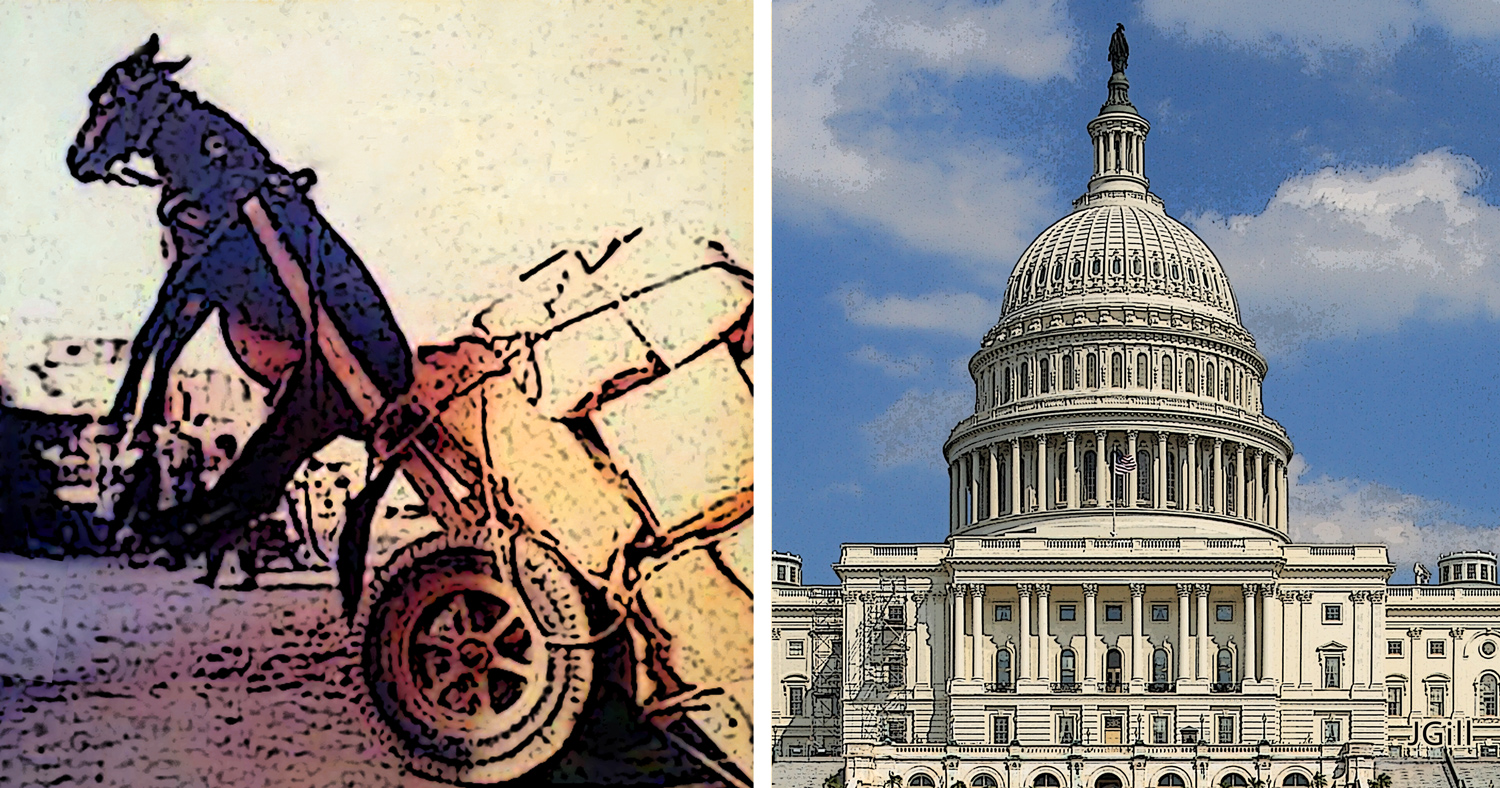

He is a huge fan of international tax competition. He likes it when governments at least marginally decrease the tax burden on prospective producers and investors, so as to lure production and investment from other tax jurisdictions. In his opinion, “we need some way to restrain the greed of the political class.”

Fans of big government disagree. Tax competition hinders their master plans to control and plunder the rest of us.

Mitchell knows that we mere U.S. citizens tend to lug a big tax load. But the United States is in fact “a tax haven. Not for Americans, of course, but … we have some good rules for foreigners.” In addition to their ability to exploit the especially robust corporate privacy rules of a state like Delaware, foreign investors can avoid taxes on interest and capital gains on their stateside investments.

Now, Mitchell says, let’s apply those “same good policies to Americans.”

Hear hear! Havens I can access are even more appealing than those I can’t.

This is Common Sense. I’m Paul Jacob.