Congressman Jared Golden, a Democrat in a Trump district, may be feeling heat.

“First, Nancy Pelosi said she’d raise taxes. Now, she’s coming for what’s left,” warns an American Action Network television advertisement airing in Golden’s Maine district.

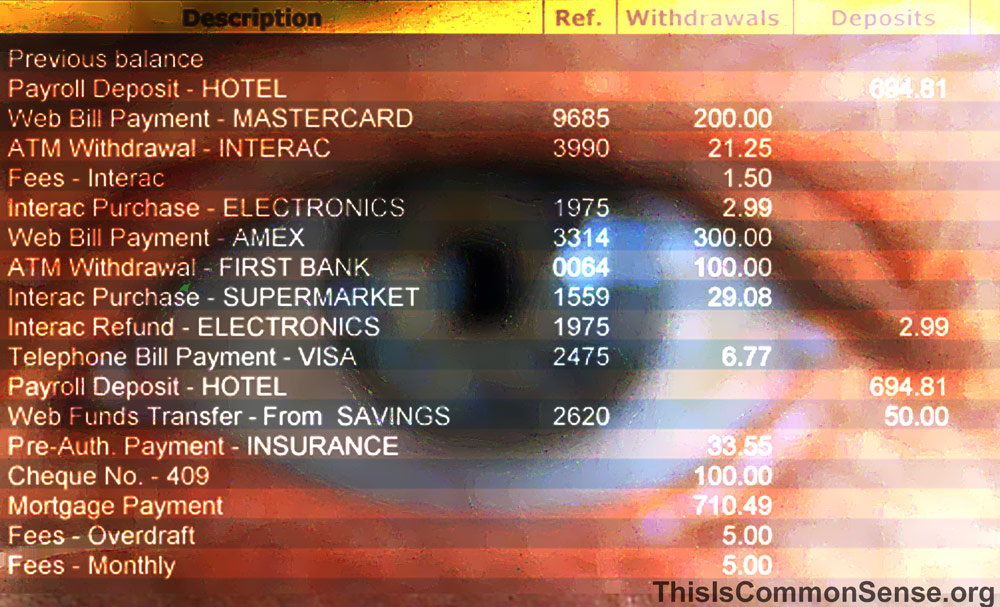

“To help pay for trillions in new spending, Pelosi wants the government to spy on nearly every American bank account, looking for new money to spend,” the spot continues. “Your deposits, payments, bank balance . . . under Pelosi’s plan, the government monitors them.

“Call Jared Golden and tell him to . . . keep the government out of your bank account.”

Fact-checking the spot, News Center Maine determined that, “yes, as part of that plan, banks would be required to give two additional pieces of information to the IRS: how much money went into certain bank accounts over the course of the year and how much came out.”

Those “certain” accounts started out being those with $600 going in or out. After the public uproar, the plan hiked the amount to $10,000.

Same principle, though.

“The only way to ensure that upper-income taxpayers pay what they owe,” explained a U.S. Treasury press release, “is by giving the IRS the resources and information required to close the tax gap.”

But does our system work that way? Not according to the Fourth Amendment.

We do not keep “a closer eye” on people making a certain amount; it is un-American to require all such “suspects” be put through the wringer the better to find a few guilty of something.

This is Common Sense. I’m Paul Jacob.

—

See all recent commentary

(simplified and organized)

1 reply on “A Closer IRS”

Guilty until proven innocent.