Well, at least they were earnest. Hopeful. Committed.

Swedes in the north part of their country channeled State pension funds — billions of kronor! — into climate-friendly projects.

Well, I’m not sure to what degree Swedish citizens were for this ideologically driven investment portfolio, but Swedish politicians sure were!

And now those investments appear iffy. “State pension fund AP2 had invested £117.7 million in Northvolt before its collapse,” explains GBN News, out of Great Britain. “It also holds £46.8 million in Stegra, plus a further £15.6 million exposure through its investment in Al Gore’s Just Climate fund.” And both Northvolt and Stegra — “once flagship companies of the energy transition,” as Blackout News puts it — teeter at the abyss of failure.

Northvolt was once Europe’s leading Great Green Hope, an electric vehicle battery company with a commitment to sustainability; in November it filed for bankruptcy protection.

Stegra was until recently seen as Sweden’s high-profile “green steel” leader, but now faces an £858 million funding gap.

There has been some shuffling of management, but even were the world’s most magical managers to pull these companies’ feet out of the fire — even if the endeavors can limp out of the current fire-sale conflagration — ask yourself: does it ever make sense to leave pension funds in the hands of zealots who seek to change the world for some utopian dream?

It makes far more sense to let private equity fund risky projects, for private fund managers have more (voluntarily given funds) on the line.

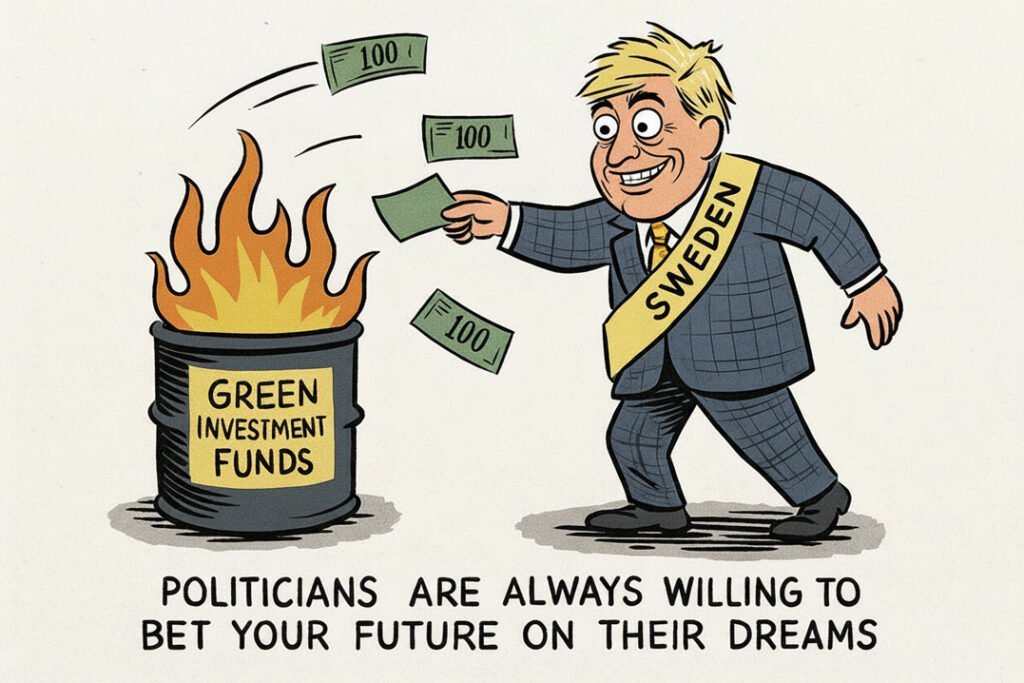

Politicians, after all, are notoriously irresponsible — always willing to bet your future on their dreams.

This is Common Sense. I’m Paul Jacob.

Illustration created with ChatGPT and NanoBanana

See all recent commentary

(simplified and organized)

See recent popular posts