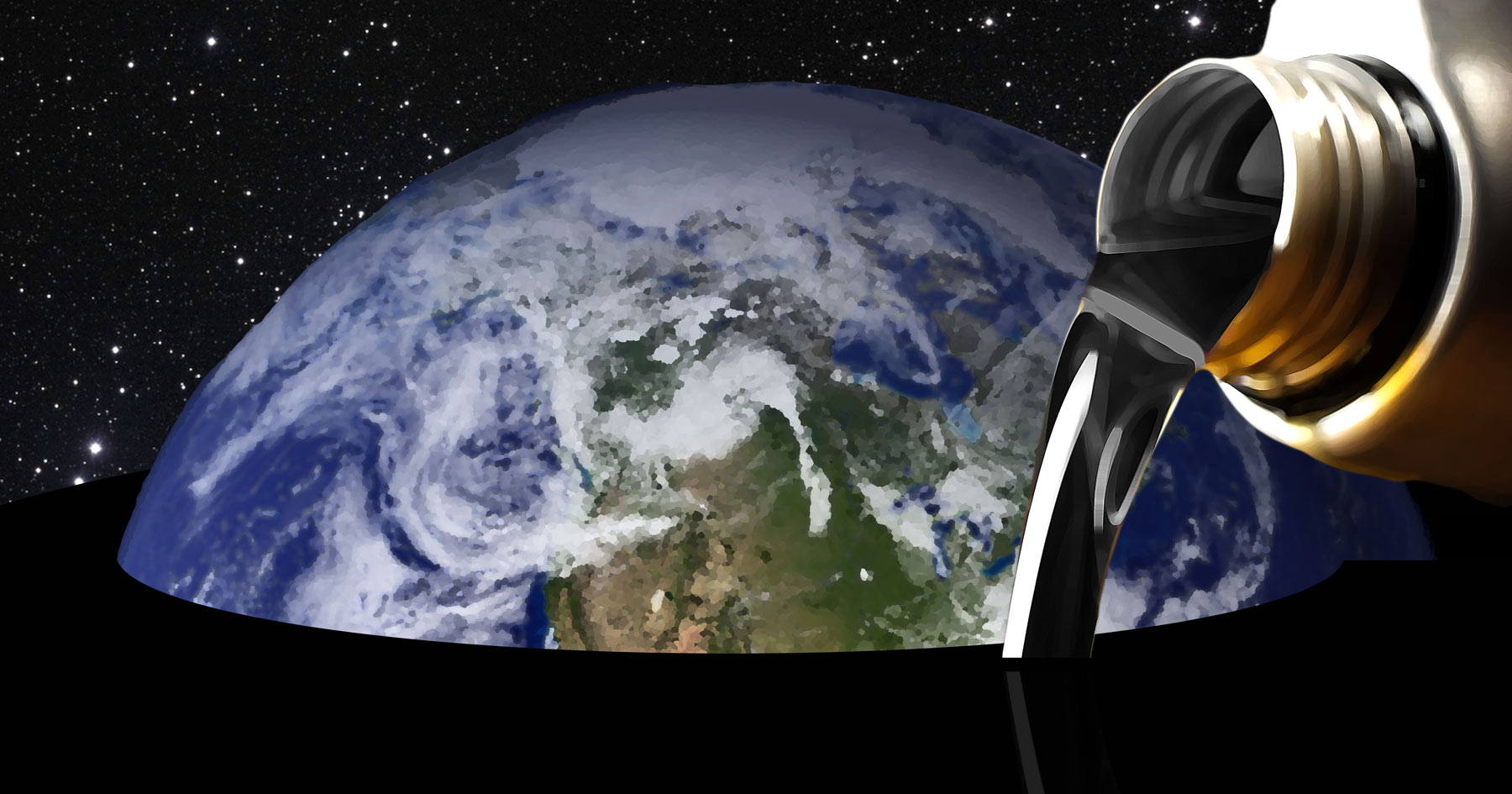

Tragedy has hit the environmental movement: The price of oil is going down.

And may go down further.

While environmentalists quiver, science writer Ronald Bailey chortles. “Resource depletionists” — the prophets of “peak oil” — should, he says, hide their heads in shame! They’ve been so very, very wrong in the prophecy biz.

As oil descends towards $20 per barrel, we should ask ourselves: where’s the tragedy? Well, it will postpone the switch to non-fossil fuels. The need is far from obvious, and the incentive is to use energy in its cheapest, most efficient forms.

But if increased CO2 in the atmosphere is destabilizing the planet’s atmosphere and ecosystem, cheaper oil (and thus more burning of it) might lead to the much-ballyhooed tragedy for all.

Still, that’s a big “if” — the more we learn about the climate, the more doubtful the identified CO2 causation and attendant doom.

Besides, global warming catastrophism’s implicit message — the “need” for global political control over everybody and everything to “manage” climate changes — seems awfully convenient for those who just love intrusive government … on “principle.”

It echoes the Keynesian technocratic conceit in economics — that experts should manage the economy by fiscal methods (increasing debt) and monetary intervention (central bank interest rate manipulation and bad asset purchase). It’s pretty obvious that they shouldn’t, because they’ve demonstrated they can’t.

As prices for oil defy “peak oil” prophets’ predictions, it becomes obvious: the world works differently than dreamed up by the prophets of doom.

This is Common Sense. I’m Paul Jacob.