Two wrongs don’t make a right.

It’s simple but true. And, as a corollary, let me add that using the power of the federal government to harass individuals or groups one happens to dislike or disagree with is wrong.

You might recall that our Declaration of Independence rebuked King George for sending “hither swarms of Officers to harass our people.” Or consider the recent civil-rights-violating behavior of the IRS against conservative groups during President Obama’s administration.

Yesterday, I proposed to end all taxpayer subsidies to Planned Parenthood. Obviously, I’m not a fan of the organization. And neither are the Republican presidential candidates — especially Louisiana Gov. Bobby Jindal.

“Planned Parenthood had better hope that Hillary Clinton wins this election,” Jindal boasted at last week’s JV presidential debate hosted by Fox News, “because I guarantee you that under President Jindal, January 2017, the Department of Justice and the IRS and everybody else that we can send from the federal government will be [looking] into Planned Parenthood.”

Speaking with reporters after the debate, Mr. Jindal doubled down, suggesting there might also be a role for the Environmental Protection Agency and perhaps other tentacles of the federal Leviathan.

Jindal has removed Planned Parenthood from Louisiana’s Medicaid program. That’s within his legitimate power. But directing an assault against anyone using the IRS and other federal agencies is both wrong and … against the law.

It promises not change but the same rotten, rights-robbing, goon-squad government we have now. Just with a different color shirt.

This is Common Sense. I’m Paul Jacob.

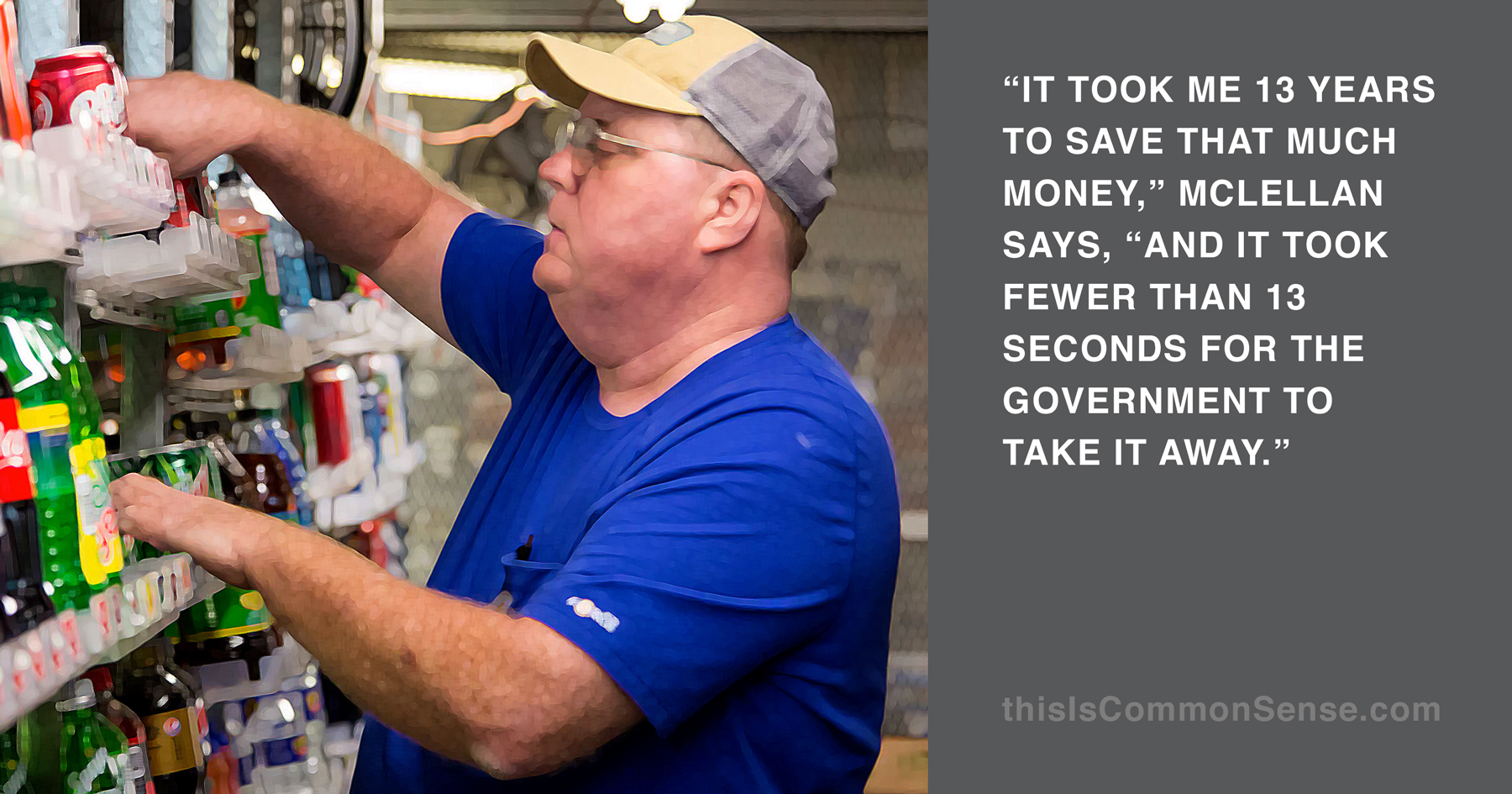

True the Vote, which combats voter fraud, sued the Internal Revenue Service because of the tax agency’s deliberate obstruction of applications from Tea Party and conservative organizations like True the Vote. The long delay in approval was costly in part because many prospective contributors to TTV had been awaiting the granting of 501(c)(3) status before going ahead with their donations. True the Vote’s president, Catherine Engelbrecht, was also

True the Vote, which combats voter fraud, sued the Internal Revenue Service because of the tax agency’s deliberate obstruction of applications from Tea Party and conservative organizations like True the Vote. The long delay in approval was costly in part because many prospective contributors to TTV had been awaiting the granting of 501(c)(3) status before going ahead with their donations. True the Vote’s president, Catherine Engelbrecht, was also