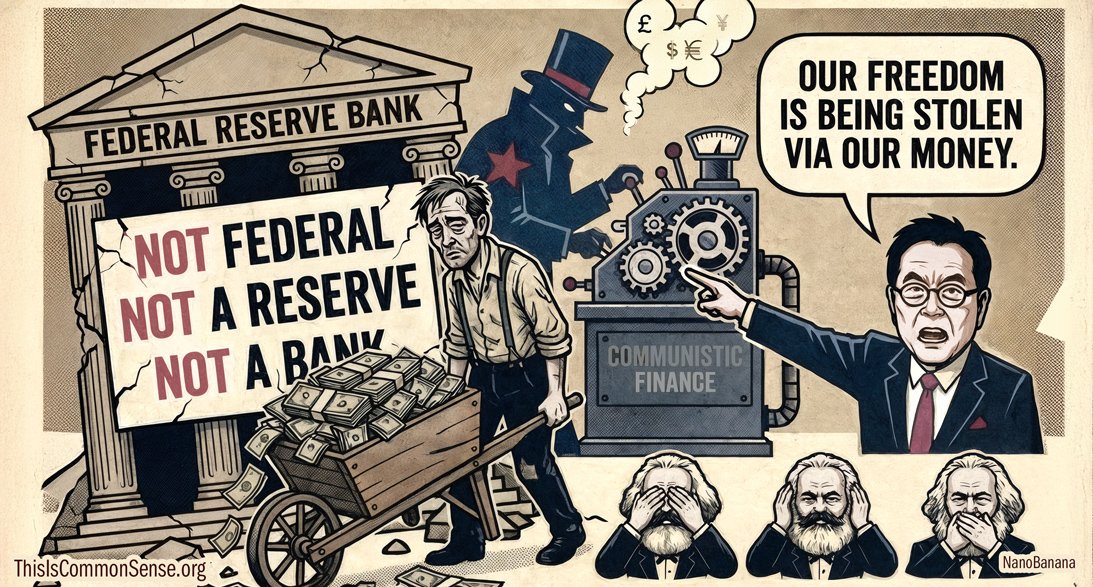

The problem is communism — in finance.

That’s the world according to Robert Kiyosaki, says an Epoch Times profile. “Kiyosaki described the U.S. Federal Reserve Bank — established in 1913 with a goal of stabilizing the nation’s monetary supply following years of extreme volatility, and preventing panic — as a Marxist organization,” Travis Gillmore writes.

“When the Fed came to America, it was the end of America,” states Kiyosaki, who co-authored a bestselling investment book, Rich Dad, Poor Dad, in 1997, “and our freedom is being stolen via our money.”

This is a familiar theme. Attacking crony capitalism as a massive swindle, and central banking as the lynchpin of bad government practices and general exploitation, that’s so basic to my view of “political economy” that I hardly bring it up anymore. It’s just so obvious.

But is our central bank communist?

If you don’t like “communist” or “socialist” you can add the suffix ‑ic: communistic or socialistic.

“As most people know, there’s a big movement to end the Federal Reserve Bank, because it’s not federal, it’s not a reserve, and it’s not a bank,” adds Kiyosaki.

“U.S. currency was once tradeable for silver or gold,” Gillmore’s article summarizes. “The Federal Reserve notes in circulation today, however, carry no guarantees, which results in significantly devalued currency.…

“Marxists want to destabilize society by ‘taking the currency,’ Kiyosaki said,” blaming this kleptocracy for the rising tide of homelessness along with other maladies.

The Epoch Times ends on a hopeful note, but does not quote recent tweets by Kiyosaki, warning us that the “biggest crash in history” is underway, predicting millions would “lose everything” while prepared investors (like himself) get richer.

All very familiar?

Sure.

But that does not mean there is no truth in it.

This is Common Sense. I’m Paul Jacob.

Illustration created with Nano Banana and Firefly

See all recent commentary

(simplified and organized)

See recent popular posts