The IRS wants to do your tax returns. Should we let it?

On this question, the agency has stacked the deck in its favor by commissioning an “independent” review by a left-wing think tank, New America, already on record in support of giving IRS officials authority to do this.

Basically, the IRS handed $15 million (of taxpayer money) to New America to say “Yes, based on our very independent review, we agree with you and ourselves about thus expanding your power over taxpayers.”

Under the proposed IRS Direct File program — already being tested in a pilot program — taxpayers would use government software to let IRS crunch the tax numbers.

Mark Tapscott’s report for Epoch Times cites many objections to the scheme.

Among the most pertinent is voiced by David Williams, president of Taxpayers Protection Alliance. He notes that when individuals and private tax preparers fill out tax forms, they’re typically trying to keep the tax take to a minimum. But the IRS won’t have the same incentive to maximize deductions and refunds.

Moreover, “There is no reason to trust the IRS with even more sensitive financial information.…”

Participation in the IRS Direct File program would not be mandatory, at least not initially.

Once established, though, the program would make it easier to mandate participation for at least some categories of tax returns.

And let us not pretend that such a development would be surprising. Governments tend to use precedents of newly granted power to expand that power.

This is Common Sense. I’m Paul Jacob.

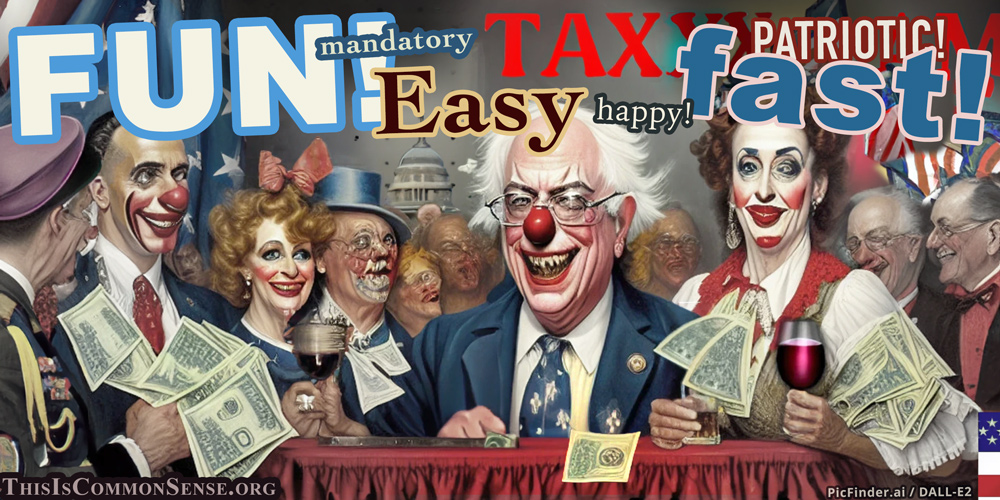

Illustration created with PicFinder.ai and DALL-E2

—

See all recent commentary

(simplified and organized)

1 reply on “Just Say NO to the IRS”

I can see how the IRS would have access to bank records for most homeowners with a mortgage, but would my township send the IRS a copy of my property tax bill if I paid it directly? I stopped filing electronically a few years ago and just mail it in, using express mail. Letting the IRS calculate my taxes for me? Thanks, but no thanks.