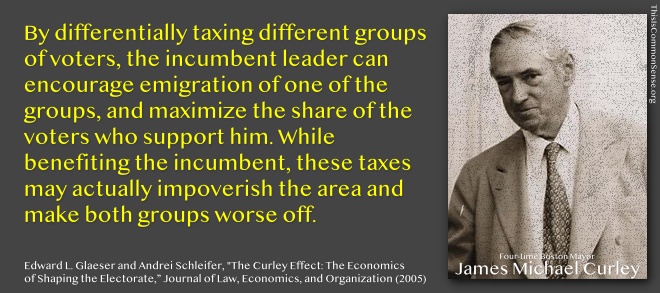

By differentially taxing different groups of voters, the incumbent leader can encourage emigration of one of the groups, and maximize the share of the voters who support him. While benefiting the incumbent, these taxes may actually impoverish the area and make both groups worse off.

Edward L. Glaeser and Andrei Schleifer, “The Curley Effect: The Economics of Shaping the Electorate,” Journal of Law, Economics, and Organization 21 (1): 1 – 19, (2005). The article’s abstract identifies the principle’s namesake: “James Michael Curley, a four-time mayor of Boston, used wasteful redistribution to his poor Irish constituents and incendiary rhetoric to encourage richer citizens to emigrate from Boston, thereby shaping the electorate in his favor. As a consequence, Boston stagnated, but Curley kept winning elections.” See David Henderson, “Curley Effect in California” (May 4, 2012).

Categories

The Curley Effect