Once upon a time, over-indulgence was considered a sin, a vice.

Not so much, nowadays.

Somewhere along the line, the idea that a little of a good thing was good, that general abundance is good, but that there can be too much of a good thing for any particular person . . . this latter common sense idea got lost.

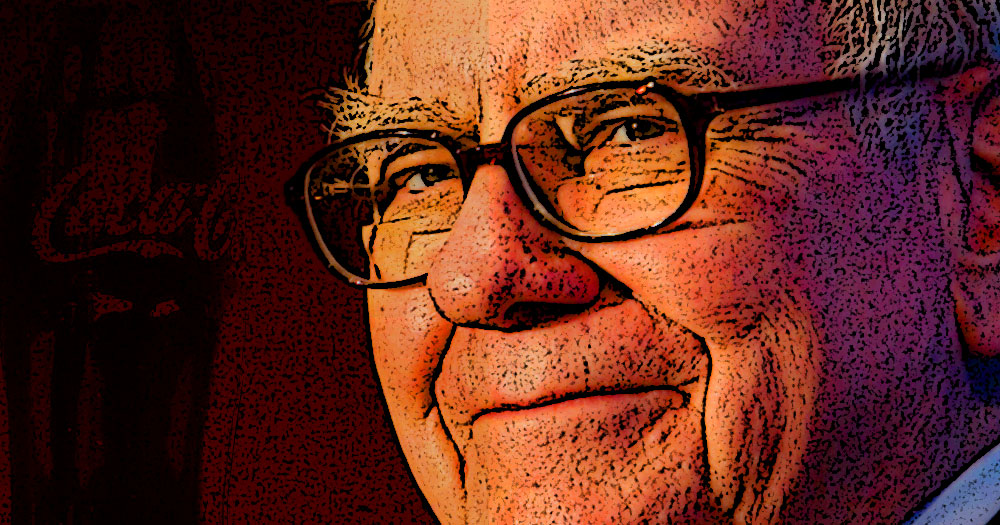

I was reminded of this while reading the latest from the nation’s most famous investor: “Warren Buffett set himself on a potential collision course with public health campaigners when he said it was ‘quite spurious’ to lay the blame for obesity and diabetes at the door of fizzy drinks companies, such as his part-owned Coca-Cola.”

The octogenarian multi-billionaire Buffet, described as a “renowned Cherry Coke drinker,” defended not only his habit but the company that produced it. He emphasized choice, consumer choice. And he said, “I make a choice to get 700 calories from Coke, I like fudge a lot, too, and peanut brittle and I am a very happy guy.”

It came up because a university study had “linked fizzy drinks to 184,000 deaths annually worldwide.”

Well, name your poison. Some folks over-indulge in alcohol; others, food; others, fizzy drinks. But Buffet limits his Cherry Coke intake, as common sense would indicate.

Gluttony used to be a vice. It was preached against. The morality of common sense held sway in our culture.

At some point hedonism in the unrestrained sense took hold of many consumers, who can pay a heavy price — if not at the grocery, at the doctor’s office.

No new laws or regulations are needed. Let everyone, billionaire or not, add up their costs and choose.

This is Common Sense. I’m Paul Jacob.

Common Sense Needs Your Help!

Also, please consider showing your appreciation by dropping something in our tip jar (this link will take you to the Citizens in Charge donation page… and your contribution will go to the support of the Common Sense website). Maintaining this site takes time and money.

Your help in spreading the message of common sense and liberty is very much appreciated!