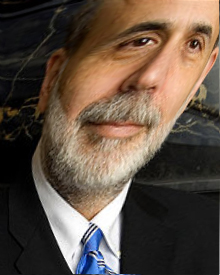

Last week, the Federal Reserve announced it was going ahead with “quantitative easing.” Chairman Ben Bernanke said that he’d be buying $40 billion dollars of mortgage-backed securities every month, no end in sight.

Now, the traditional way that the Federal Reserve influenced the money supply, economist Randall Holcombe explains, was via “open market operations by buying and selling government securities.” But this changed in 2008 with the $85 billion AIG bailout: “Since then it has engaged in continual bailouts of financial firms and purchases of non-government securities.…

The Fed has moved from engaging in monetary policy in a way that was neutral toward various businesses and industries in the economy to one in which monetary policy is targeted toward specific firms and industries. This current foray, specifically targeted at the housing market, is crony capitalism.

It’s actually worse. It’s crank policy, as the redoubtable Mr. Peter Schiff summarizes: “Ben Bernanke’s plan to revive the U.S. economy and create jobs is to inflate another housing bubble. That’s it. That’s what the Fed’s got. That’s what it came up with. As if the last housing bubble worked out so well for the economy that the Fed wants an encore.”

Our leaders are obviously desperate.

And out of control. George Will states that the Fed has gone far beyond “mission creep” — it’s “mission gallop on part of the Fed, which is on its way to becoming the fourth branch of government — accountable to no one and restrained by nothing, as far as I can tell, in exercising both monetary and fiscal policy.”

This is what forsaking limited government and the Constitution gets you: a sort of frantic idiocy in aid of politically connected speculators and financiers.

This is Common Sense. I’m Paul Jacob.

4 replies on “The Bernanke Stretch”

Paul, this is the third intervention into the housing market, before the last boom/bust of Freddie and Fannie there was the HUD program which decimated the central cities. The last foray was simply the HUD program on steroids, which was hatched as a bright “new” idea after the original inventors of the use of the financial sector as a welfare tool were retired from office and mostly dead. No learning from history in Washington.

The present quantitative easing is more desperate and ominous. It is more probably the result of the markets rejection of additional securities from Fannie and Freddie. The last attempt poisoned the banking and insurance sectors. This will do the same for the dollar as a reliae monetary unit directly.

Hold on, it is going to be quite a ride.

Oh, great. Now another branch of government shooting from the hip and only restrianed by whim. Add that to the 3 branches at the capital. Looks like the only folks with restraint now are the citizens and that is beginning to chaff as the boot on the throat is pressed down more.

.… This is the consequence of the forsaking of limited government and of the united States’ Constitution: a sort of frantic idiocy in aid of “politically connected ‘speculators’ and ‘financiers’ ” .…

Or, in other words is a sort of frantic felonious feeding frenzy involving the looting and rorting of the earned and owned wealth of America’s and therefore of the world’s most creative, innovative, industrious and productive Men and the laundering of that confiscated wealth to Obama’s criminal “government” Gang’s cohorts, cronies and co-conspiritors.

Kicked off, this month, with the DNC-Fed’s Economics illiterate, Bernanke’s, Eighty Billion Dollar DNC/FEC-facilitated “political donation.”

And a reminder of the adage that a single thief, acting alone, is an outlaw but a gang of thieves that manages to control the institutions of the state, finds it may compel the Law to its service;

That a counterfeiter is sent to prison and a central banker is rewarded with a knighthood;

A blackmailer who extorts is convicted, a taxman who does the same thing, is supported by the taxpayers whom he is fleecing;

That while the kidnapper who holds to ransom expects a long prison sentence, a tax-evading cabinet secretary expects to retire with a handsome pension.

That the story of our beloved fraternal republic — long both the vanguard and the guardian of Human Civilization — requires the holding to account those who govern us and the prevention of their systemic looting. And that now, at the federal level, those that loot have escaped the bounds of public opinion and we see generational poverty being inflicted without any recourse for the victims.

There is, we pray and trust, a way out. And may the G‑d of Israel give President-elect Romney the direction and the strength to oversee every individual American once again running his own affairs in his own best interest.

And, as the consequence, our nation growing our way back to growth!

(With both thanks and apologies to the inimitable Daniel Hannan Esquire, MEP)

Just whom are they trying to kid? The Federal Reserve is not the fourth branch of our government. It is privately owned ( by the “money changers”).