Taxing capital gains is a form of income taxation that Democrats love.

And it’s not just a matter of increasing revenue. Remember that President Obama thought that increasing the capital gains rate was a good idea even if it decreased government revenue. Democrats are playing to a soak-the-rich sentiment among their base, even when the most important supporters are billionaires.

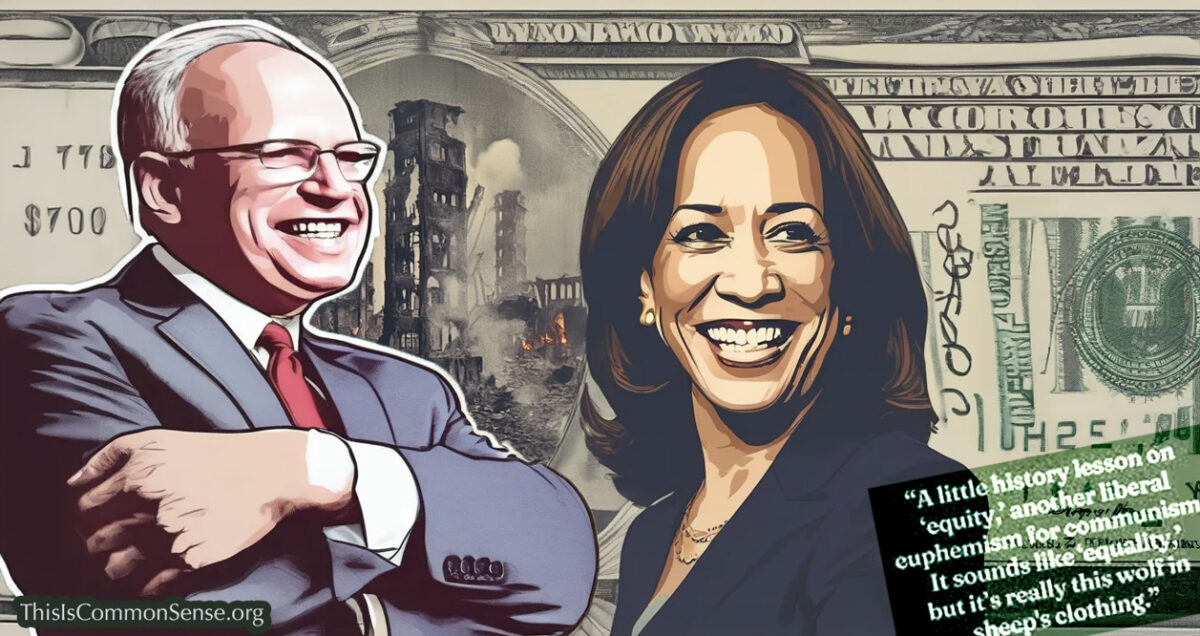

Take Mark Cuban. He’s a billionaire. And he supports Kamala Harris for president.

Weeks ago, the Democrat standard-bearer came out with a wild proposal to tax unrealized capital gains. And Cuban, for all his faults, is not an idiot; he knows just how incredibly corrosive that tax on capital would be.

“It would kill the stock market,” he points out.

In a chat with Fox Business, Cuban explained how he told Democratic insiders that taxing unrealized capital gains (as when stocks you hold gain value, but you haven’t sold them so you have no income from them), would become “the ultimate employment plan for private equity, because companies are not going to go public because you can get whipsawed, right?”

By this he means that a stock owner might have to borrow money to cover taxes, only to have the stocks go down later and enjoy neither rebate from the government nor any income from the investment to cover the debt.

Cuban insists that Democratic insiders are pragmatic and will not push this tax.

Yet, with both members (comrades?) of the presidential ticket spouting Marxist talking points, how do we know that they are stable (corrupt?) enough to save public capitalism from their malign agenda?

How can we be sure they’re just lying?

This is Common Sense. I’m Paul Jacob.

Note: Since unrealized capital gains aren’t income, I don’t know how taxing them could be constitutional. Perhaps someone can explain this to me.

Illustration created with PicFinder and Firefly

See all recent commentary

(simplified and organized)

See recent popular posts

3 replies on “Kill the Stock Market!”

Cuban’s argument fails to recognize that an army of assessors would be assembled to impute valuations to private equity, so that it too could be taxed.

As to the question of “how taxing them could be constitutional”, always bear in mind that the corporate left want Supreme Court Justices who hold that the constitution just is what “progressive” thinkers believe that it ought to be, regardless of whatever was meant by the words of the Constitution at the times of adoption. The left has previously called for a variety of changes — impeachment of Justice Alito and especially of Justice Thomas, term-limits* or age-limits for Justices, and increases to the size of the Court — each change hoped to ensure that a “progressive” majority or replaces or displaces the present majority. And the New York Times has now published multiple pieces arguing that the Constitution needs to be set aside.

— — — — — — — — — —

* Equation of term-limits for elected officials with term-limits for Justices is foolish. The benefits of term-limits are in their effects on the incentives of officials. Justices, never seeking reëlection, do not have the incentives of officials who do.

In order to enact a tax on unrealized gains, Congress should have to define ‘income’. Our many sources of ‘income’ are defined in the tax code, but are they constitutional, given certain court decisions made after the first income tax was enacted, both before and after ratification of the 16th Amendment. Neither of these decisions has been struck down and John Roberts referenced them in his Obamacare decision.

From consitutioncenter.org:

In an 1894 decision (Pollock), the Court reasoned that taxing income from property was tantamount to taxing the property itself. The 16th Amendment, passed later, references a tax on income, not on property.

“In Eisner v. Macomber (1920), the Court struck down an unapportioned income tax as applied to certain stock dividends, holding that they effectively fell on property, not income; other cases from the 1920s made similar distinctions.”

How much of our income tax system today is constitutional, given these court decisions? If a tax on dividends has been ruled a tax on ‘property’, how can the federal government tax you on any gains made from the sale of ‘property’, whether it’s stocks or land or businesses?

Taxocrats like to equate the unrealized gain on stocks tax grab to taxation applied to real estate property values. Your home value goes up with market conditions, the assessed value values go up and your taxes go up at least some depending on whatever exemptions are applied. They say that it is the same concept, as if the comparison is a selling point.

Some of these boneheaded proposals of theirs are to balance their tax and spend budgets on paper and of course to flame resentments for political gain. They pretend that the taxation would only affect a small group, produce dependable ongoing income rather than flight, as they deny or remain oblivious to economic and other structural permutations.

They do not care about such things if they win. They will deal with such in a progression of cascading controls, managed by them of course, oblivious or uncaring about economic prosperity for the masses. The logic of Marxism is relentless however evil and stupid.

The concept of a rising tide of economic activity raising all boats — the benefit of market capitalism — efficiency, economic responsiveness and freedom are entirely foreign, unimportant, and counter revolutionary to them.

Marxists do not love people they are disdainful of them and their individual choices. Their long view is one-world managed government. You will own nothing. The wealthy that support them are one or more of: macro-economic ignoramuses, figure they will be protected, are tied to government and big government is good for their business, or are softheaded trust babies without a real-world clue but a marxist world view.

I certainly do not have all the answers to funding government although I am pretty sure less government would be easier to fund. A value added sales/ economic activity based tax that avoids taxing idle property (tangible and intangible including savings and paper gains on investments) seems more amenable to smaller government, less intrusive, gives everyone a stake in good government.