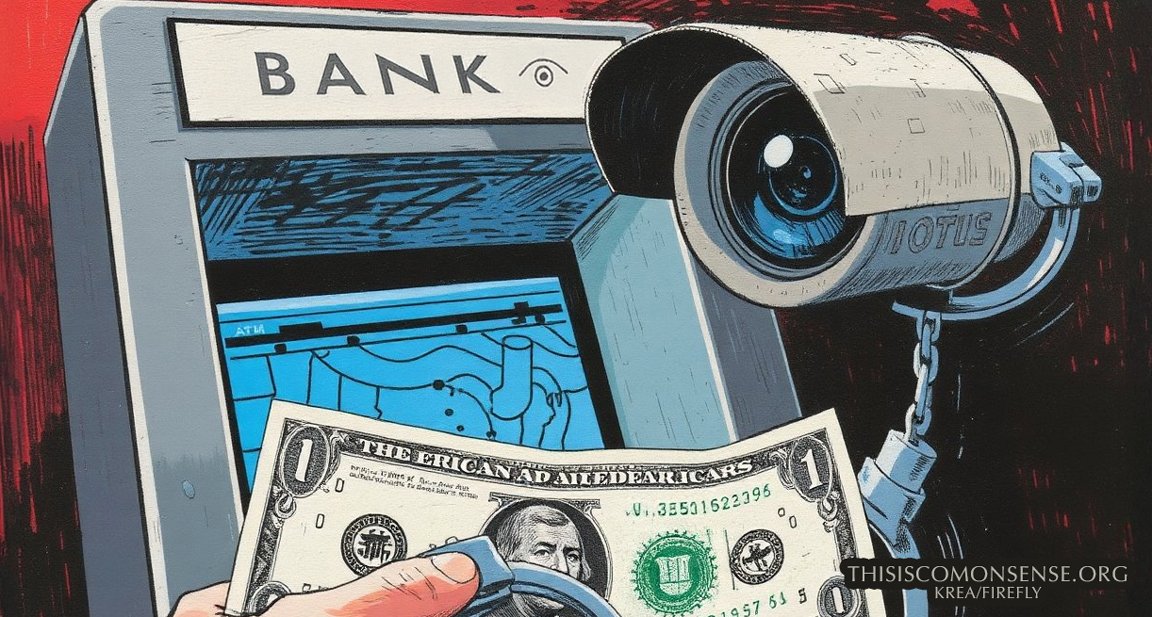

A recent executive order that President Trump issued to stop regulators from abetting and even compelling the “debanking” of bank customers for their political views is clear and on-target.

On-target as far as debanking by banks goes.

But Reclaim the Net notes a glaring omission. The order’s identifies financial institutions willing to blacklist customers for possessing the “wrong” political opinions or missions. (“Wrong” here means not too pro-criminal or pro-terrorist but too constitutionalist, too much in favor of individual rights of the First or Second Amendment variety.)

The problem is that the order says nothing about major payment processors like Visa and PayPal.

Now, perhaps a penumbra of the new regulatory marching orders would influence the policies of the credit-card companies, whose cards are after all typically issued in cooperation with banks. But this is highly uncertain.

And Reclaim the Net thinks that Visa and Mastercard, “the twin tollbooth operators of the global payments highway,” are, like PayPal and Stripe, untouched by Trump’s order. Yet all of these payment processors have in recent years been blacklisting individuals and organizations that the processors happen to disagree with.

The practice goes back at least to the Obama administration, which instructed regulators that it could regard something called “negative public opinion” as a legitimate risk factor.

This doctrine “quickly turned into a permission slip for politically driven account closures.”

The government shouldn’t be issuing such “permission slips” — or implicit instructions — to banks, payment processors, or anybody.

This is Common Sense. I’m Paul Jacob.

Illustration created with Krea and Firefly

See all recent commentary

(simplified and organized)

See recent popular posts