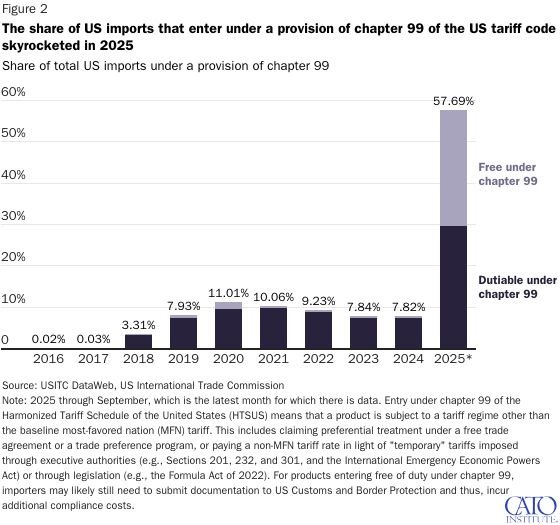

As of September, Scott Lincicome and Alfredo Carrillo Obregon write, “more than half of all US imports (by value) were subject to one or more special tariff measures (i.e., classified in Chapter 99 of the Harmonized Tariff Schedule of the United States) and to the associated bureaucracy.”

Though there has been legal action against Donald Trump’s diktat-approach to tariff policy, the Cato authors don’t put much hope in these challenges. “Regardless of what the Supreme Court does with Trump’s ‘emergency’ tariffs, moreover, US tariff red tape will likely grow more this year, burdening US companies and the economy in the process.”

And growing red tape is a drag on economic growth. It is a prime strangler of growth.

But there is more than one challenge to Trump’s tariff mania. They’re not all equally feckless, are they?

The Supreme Court’s forthcoming decision in the Learning Resources Inc. et al. v. Trump case could significantly reduce the complexity of the US tariff system if the Court invalidates the Trump administration’s IEEPA tariffs. Such reprieve, however, would likely be temporary because the Trump administration has pledged to replicate the IEEPA regime through other executive tariff authorities, including through both Sections 232 and 301 measures, and previously unused statutes such as Section 122 of the Trade Act of 1934 and Section 338 of the Tariff Act of 1930. (Though, such authorities arguably have more built-in procedural and/or substantive checks than IEEPA does.) This system, in fact, might be even more complex than what we have right now.

It will therefore remain the case that a true reduction in tariff red tape will only be accomplished through congressional action to revise various US trade laws and reclaim the legislative branch’s constitutional authority over tariffs.

This needless complexity all comes back to Congress, which could fix it, but chooses not to. A familiar problem.

Also all-too-familiar is fundamental confusion about tariffs. For some reason, Americans don’t think of tariffs as taxes. But tariffs are just another form of taxation, of course, no matter what is popularly believed. And can anything show how far from the Reagan Revolution the Trumpian movement is than seeing Republicans rally around an enthusiastic taxer?

One reply on “Tariffs Are Taxes”

The tariff case might be the last best chance for the Supreme Court to restore the Constitution of the United States of America as, well, the constitution of the United States of America. Justice Gorsuch identified the logical problem of delegation by Congress of its own responsibilities — the Constitution makes no provision for a simple majority to over-ride a Presidential veto of rescission, making any delegation effectively an amendment of the constitution, which Congress has no power to make.

We should hope, then, that Gorsuch will not back-down at the least creating embarrassment for any Justice who tries to square the judicial circle, as did Justice Roberts in the case of the unconstitutional tax on those who chose not to buy medical insurance.

The shock both to the New(est) Right and to the political left would be palpable. The highest court in the land would declare and end to Imperial Presidency and to the Administrative State. The responsibility to declare war, and at the federal level to establish taxes and to write laws would be thrust back upon Congress.

I’m sure that Justice Roberts does not have the stomach for such a change. I suppose then the questions are of whether Justices Kavanaugh and Coney Barrett do.